views

U.S. Mechanical Tube & Pipe Market

The U.S. mechanical tube & pipe market size was valued at USD 2.44 billion in 2023 and is projected to grow from USD 2.49 billion in 2024 to USD 2.99 billion by 2032, exhibiting a CAGR of 2.3% during the forecast period. The U.S. mechanical tube and pipe market has seen significant growth in recent years, driven by several key industries that rely on these essential components. With applications ranging from construction and automotive to energy and industrial machinery, the market’s outlook is robust. In this article, we will delve into the dynamics, trends, challenges, and growth projections for the U.S. mechanical tube and pipe market.

LIST OF TOP U.S. MECHANICAL TUBE & PIPE COMPANIES:

- Nucor Corporation (U.S.)

- Tenaris S.A. (Luxembourg)

- Cleveland-Cliffs Inc. (U.S.)

- U.S. Steel Corporation (U.S.)

- Atkore (U.S.)

- Valmont Tubing (U.S.)

- Vallourec (France)

- Bull Moose Tube (U.S.)

- Metallus Inc. (TimkenSteel)

- Zekelman Industries (U.S.)

Overview of the Mechanical Tube & Pipe Market

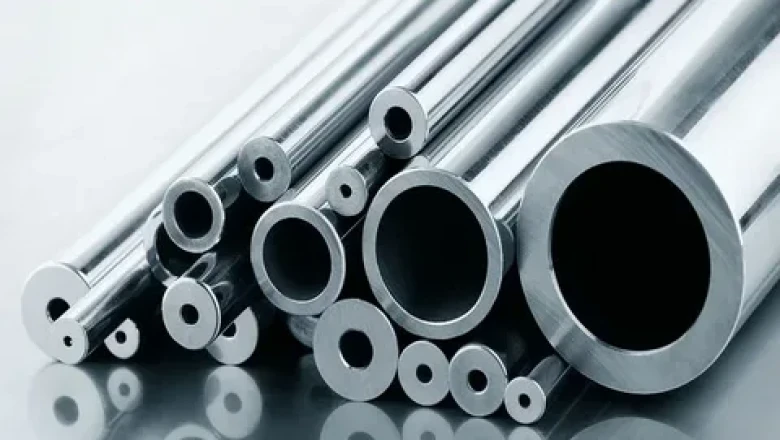

Mechanical tubes and pipes are widely used for structural, transportation, and energy applications. These products are made from materials such as steel, stainless steel, and aluminum, which are then processed into different forms like welded, seamless, and threaded pipes. Mechanical pipes are designed to withstand various pressures, temperatures, and environments, making them crucial for a range of applications including piping systems, frameworks, transportation, and even specialized equipment.

Market Drivers

Several factors contribute to the growth of the U.S. mechanical tube and pipe market, including:

- Construction Industry Growth The construction industry is a primary driver for the demand for mechanical tubes and pipes. These products are extensively used in structural applications, including the construction of buildings, bridges, and other infrastructure projects. With ongoing investments in infrastructure renewal and urban development, the need for high-quality mechanical tubing is expected to remain strong.

- Automotive and Aerospace Sectors Both the automotive and aerospace industries rely heavily on mechanical tubes and pipes for manufacturing vehicles and aircraft. The rise of electric vehicles (EVs) and innovations in aerospace technologies are anticipated to boost the demand for specialized tubing solutions, including lightweight, high-strength pipes made from advanced materials like aluminum and titanium.

- Energy and Utilities The oil and gas industry is another significant end-user of mechanical pipes and tubes. These products are essential for drilling, transportation, and processing systems. With a growing emphasis on natural gas and renewable energy sources, the market for mechanical tubing in energy applications continues to expand.

- Industrial Equipment and Machinery Mechanical tubes and pipes are used extensively in industrial machinery and equipment, including hydraulic systems, heat exchangers, and pressure vessels. As industries adopt more automated and efficient machinery, the demand for these components is set to rise.

Technological Advancements

The mechanical tube and pipe market in the U.S. has seen substantial advancements in technology, which have contributed to both the quality and efficiency of production. Some of the key technological trends include:

- Additive Manufacturing (3D Printing): Increasing use of 3D printing for producing customized pipe components with intricate geometries is emerging as a significant trend. This innovation is reducing material waste and improving the overall design flexibility of mechanical tubing.

- Advanced Coatings and Treatments: New coatings and surface treatments enhance the performance and durability of pipes, especially for applications in harsh environments such as the oil and gas sector. These innovations help prevent corrosion and extend the lifespan of pipes, ensuring lower maintenance costs.

- Automation in Manufacturing: The adoption of automation in manufacturing processes has streamlined the production of mechanical tubes and pipes, improving precision and reducing production costs.

Challenges Faced by the Market

While the U.S. mechanical tube and pipe market is growing, it also faces certain challenges:

- Raw Material Price Fluctuations: The cost of raw materials such as steel, aluminum, and stainless steel can fluctuate significantly, affecting the cost of production for manufacturers. These price variations are often tied to global supply chains, economic conditions, and geopolitical factors.

- Environmental Regulations: Stricter environmental regulations around production processes and the sustainability of materials are pushing manufacturers to adopt greener practices. This requires investment in cleaner technologies and materials that meet compliance standards.

- Competition from Global Markets: While the U.S. has a large domestic market for mechanical pipes and tubes, competition from low-cost manufacturers in countries such as China and India continues to pose a challenge. U.S. manufacturers must remain competitive by focusing on quality, innovation, and customer service.

Information Source: https://www.fortunebusinessinsights.com/u-s-mechanical-tube-pipe-market-106579

Growth Projections

The U.S. mechanical tube and pipe market is projected to experience steady growth over the next several years. According to industry reports, the market is expected to grow at a compound annual growth rate (CAGR) of around 4.5% from 2024 to 2030. Several factors will contribute to this growth:

- Continued Investment in Infrastructure: The U.S. government has committed to investing in infrastructure development, including highways, bridges, and renewable energy projects, which will drive the demand for mechanical tubes and pipes.

- Technological Advancements in Manufacturing: As manufacturers continue to adopt new technologies such as automation, 3D printing, and advanced coatings, the efficiency of production processes will improve, supporting market growth.

- Rising Demand from the Energy Sector: The transition toward cleaner energy sources and the growth of renewable energy infrastructure are expected to increase the demand for specialized mechanical tubes and pipes in the energy sector.

The U.S. mechanical tube and pipe market is poised for continued growth, driven by the construction, automotive, energy, and industrial machinery sectors. With technological advancements enhancing production capabilities and increasing demand across key industries, the market is expected to remain dynamic in the coming years. However, challenges such as raw material costs, environmental regulations, and international competition will require ongoing attention from manufacturers.

Comments

0 comment