views

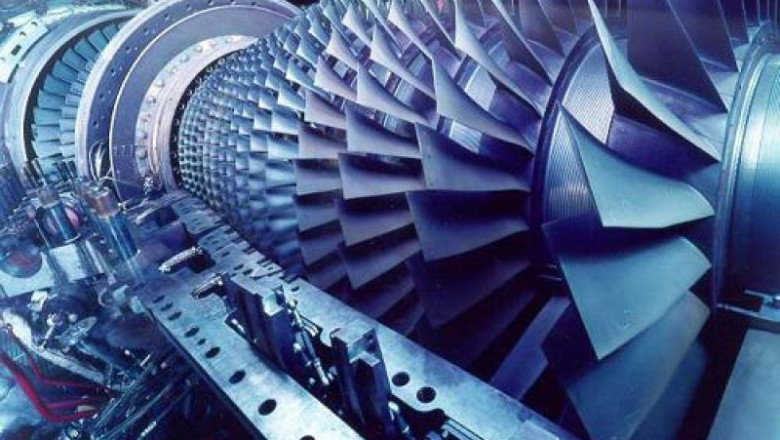

The global gas turbine services market encompasses a full suite of aftermarket offerings—maintenance, repair, overhaul (MRO), spare parts provisioning, performance upgrades, and remote monitoring—designed to maximize the efficiency and reliability of gas turbines in power generation, oil & gas, and industrial applications. As aging turbine fleets face increasing downtime and efficiency losses, service providers leverage advanced diagnostics, refurbishment techniques, and customized retrofits to restore turbines to OEM specifications or enhance output. Customers benefit from extended equipment life, reduced unplanned outages, optimized fuel consumption, and compliance with stringent environmental regulations.

Gas Turbine Services Market Service agreements range from on-site inspections and field support to comprehensive overhaul campaigns at specialized workshops, offering predictable maintenance schedules and cost models that improve budgeting and return on investment. With the market scope expanding into predictive maintenance and digital twin technologies, operators gain real-time insights into turbine health, driving better decision-making and lower operational expenditures. As the industry confronts market challenges such as volatile fuel prices and regulatory shifts, service providers adapt with modular solutions and growth strategies focused on emerging economies.

The gas turbine services market is estimated to be valued at USD 44.57 Bn in 2025 and is expected to reach USD 80.95 Bn by 2032, growing at a compound annual growth rate (CAGR) of 8.9% from 2025 to 2032.

Key Takeaways

Key players operating in the Gas Turbine Services Market are General Electric, Siemens AG, Mitsubishi Power, Rolls-Royce, and Ansaldo Energia. These market companies account for significant market share with extensive portfolios that cover everything from field services to digital analytics. Their global service networks, robust supply chains, and continuous market research investments underpin their leadership in market segments ranging from simple-cycle turbines to complex combined-cycle installations.

The market opportunities in the gas turbine services sector are driven by growing industrialization, rising energy demand in emerging economies, and the industrial shift toward lower-emission power sources. Service providers can tap aftermarket revenue streams through long-term service agreements, performance-based contracts, and digital subscription models. There is a clear expansion route into fast-developing markets in Asia-Pacific and Latin America, where aging fleets require modernization. Additionally, collaborations between OEMs and third-party service specialists create co-development opportunities in refurbishment and life-extension programs, offering significant business growth potential. Market insights suggest that bundling predictive maintenance solutions with traditional MRO services will open new revenue avenues and strengthen customer loyalty.

Technological advancement in the gas turbine services market centers on the adoption of digital twin technology and predictive analytics. By creating virtual replicas of physical turbines, operators gain actionable market analysis on component wear, vibration patterns, and combustion dynamics. Advanced sensors feed continuous data streams into machine-learning algorithms, enabling early fault detection and remaining-useful-life estimations. This technology-driven trend aligns with broader industry trends toward Industry 4.0 and smart manufacturing, where real-time performance monitoring reduces unplanned downtime and cuts operational costs. Integration of Internet of Things (IoT) platforms and cloud-based analytics further enhances remote diagnostics, allowing service engineers to deliver targeted maintenance and optimize asset performance across multiple sites.

Market Drivers

One of the primary market drivers fueling the gas turbine services market is the escalating demand for operational efficiency and asset reliability amid rising energy consumption. As utilities and industrial operators face mounting pressure to maximize uptime and reduce lifecycle costs, the need for sophisticated maintenance solutions—including predictive maintenance powered by digital twin technology—becomes imperative.

This focus on performance optimization facilitates higher combined-cycle efficiency, lowers greenhouse gas emissions, and aligns with regulatory imperatives for cleaner energy. Additionally, the shift toward service-based business models enables customers to convert capital expenditures into predictable operating expenses, strengthening financial planning and business growth strategies. Together, these factors drive market growth by encouraging long-term service contracts, accelerating aftermarket penetration, and boosting overall market revenue.

Current Challenges in the Gas Turbine Services Industry

The gas turbine services sector is navigating a complex landscape of market challenges that stem from evolving regulations, operational demands, and shifting energy portfolios. Aging equipment in many regions requires intensive overhaul and retrofitting, driving up maintenance costs and forcing service providers to optimize turnaround times. Simultaneously, stringent environmental standards are pushing operators to adopt cleaner combustion technologies, which necessitates new inspection protocols and specialized component upgrades.

Digitalization remains a double-edged sword: predictive analytics and remote monitoring offer clear market insights and improved uptime, but integration hurdles and cybersecurity concerns slow widespread implementation. Supply chain disruptions—illustrated by parts shortages and extended lead times—further constrain service delivery, compelling organizations to diversify suppliers and establish local repair hubs. A tight talent pool of skilled technicians adds pressure, as industry veterans retire and few newcomers possess the advanced skill sets required for high-precision diagnostics. These factors combine to shape the market dynamics and set the stage for evolving market trends over the forecast horizon.

SWOT Analysis

Strength:

• Comprehensive service portfolios allow established providers to offer full-life-cycle care, from on-site repairs to remote monitoring, driving stronger customer loyalty and recurring revenue.

• Advanced digital tools—such as AI-driven health monitoring—enable real-time insights and predictive maintenance, reducing unscheduled downtime and optimizing asset utilization.

Weakness:

• High dependency on legacy equipment in mature markets limits rapid adoption of new technologies, leading to compatibility concerns and increased retrofitting costs.

• Fragmented service networks create inconsistencies in quality control and spare-parts availability, elevating project risk and lengthening response times.

Opportunity:

• Growing interest in green hydrogen and biofuel blends opens avenues for service companies to develop specialized combustion module upgrades and fuel-flexible components.

• Emerging regions investing in power infrastructure create market growth potential for localized maintenance centers and training programs tailored to regional grid requirements.

Threats:

• Intensified competition from low-cost regional players may exert downward pressure on service margins and erode long-standing customer relationships.

• Volatile commodity and raw-material prices increase input costs for replacement parts, potentially delaying project schedules and straining supply-chain resilience.

Geographical Regions – Value Concentration

Demand for gas turbine services is heavily concentrated in regions with well-established power generation and petrochemical industries. North America leads in terms of service revenue, driven by extensive combined-cycle installations and a mature aftermarket ecosystem. Operators in the United States and Canada rely on comprehensive overhaul programs and digital diagnostic solutions to meet efficiency targets and regulatory requirements. Europe follows closely, where stringent emissions standards and aging infrastructure spur frequent maintenance campaigns and technology upgrades.

Market segments in Germany, the U.K., and Scandinavia emphasize retrofit packages that improve fuel efficiency and reduce carbon output. In Asia Pacific, advanced economies like Japan and South Korea generate significant service activity around industrial gas turbines used in manufacturing and district heating. Collectively, these regions account for a substantial share of global service contracts, reflecting both historical installation volumes and ongoing commitments to reliable energy production.

Fastest Growing Region for Gas Turbine Services

Asia Pacific is poised to register the fastest growth in gas turbine services, propelled by robust power demand, rapid urbanization, and expanding petrochemical capacity. Nations such as India and Vietnam are commissioning new combined-cycle plants to bolster grid stability and reduce reliance on coal, driving urgent requirements for installation, commissioning, and aftermarket support. Southeast Asia’s focus on energy diversification—integrating renewables with gas peaker units—creates lucrative market opportunities for quick-turnaround maintenance and performance optimization.

Meanwhile, the Middle East & Africa region is witnessing increasing investments in gas-fired power infrastructure, especially in Gulf Cooperation Council countries seeking to monetize natural gas reserves. Customization needs for desert-climate operations, alongside strategic partnerships for local content development, are reshaping market dynamics and fueling business growth among service providers targeting these emerging hotspots.

Get this Report in Japanese Language: ガスタービンサービス市場

Get this Report in Korean Language: 가스터빈서비스시장

Read More Related Articles- Common Types and Features of Gas Leak Detectors Used in the United States Gas Detector Technologies

Author Bio:

Money Singh is a seasoned content writer with over four years of experience in the market research sector. Her expertise spans various industries, including food and beverages, biotechnology, chemical and materials, defense and aerospace, consumer goods, etc. (https://www.linkedin.com/in/money-singh-590844163)

Comments

0 comment