views

"Finance Cloud Market - Size, Share, Industry Trends, Demand and Opportunities

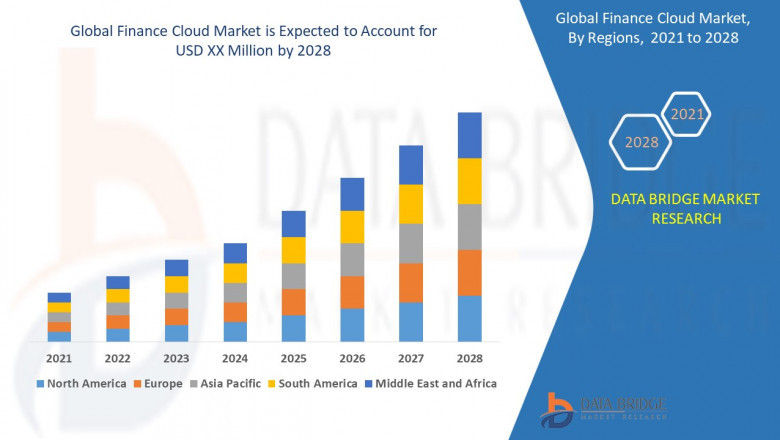

Global Finance Cloud Market, By Type (Solution, Service), Application (Revenue Management, Wealth Management System, Account Management, Customer Management, Others), Deployment Model (Public Cloud, Private Cloud, Hybrid Cloud), Sub-Industry (Banking and Financial Services, Insurance), Organization Size (Small Enterprises and Medium Enterprises, Large Enterprises), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa) Industry Trends and Forecast to 2028.

Access Full 350 Pages PDF Report @

https://www.databridgemarketresearch.com/reports/global-finance-cloud-market

**Segments**

- **Deployment:** The global finance cloud market can be segmented based on deployment into public, private, and hybrid cloud. Public cloud deployment offers cost-effective solutions, while private cloud provides enhanced security and customization options. Hybrid cloud combines the benefits of both public and private clouds, allowing organizations to optimize their financial operations.

- **Enterprise Size:** Another important segmentation factor is enterprise size, which includes small and medium-sized enterprises (SMEs) and large enterprises. SMEs are increasingly adopting finance cloud solutions to improve efficiency and reduce costs, while large enterprises are leveraging these technologies to scale their operations and drive innovation.

- **Service Model:** The finance cloud market can also be segmented based on service models such as Software as a Service (SaaS), Platform as a Service (PaaS), and Infrastructure as a Service (IaaS). SaaS offers ready-to-use financial applications, PaaS provides a platform for developing custom financial solutions, and IaaS offers infrastructure resources on a pay-as-you-go basis.

- **End-User:** End-user segmentation in the finance cloud market includes banking, financial services, and insurance (BFSI), healthcare, retail, manufacturing, and others. Each industry vertical has unique financial requirements, and cloud solutions tailored to these specific needs can drive digital transformation and competitive advantage.

**Market Players**

- **Salesforce.com, inc.:** Salesforce is a leading provider of cloud-based customer relationship management (CRM) solutions, including financial services cloud for the banking and insurance sectors.

- **Oracle Corporation:** Oracle offers a comprehensive suite of finance cloud solutions, including enterprise resource planning (ERP) and financial management applications.

- **IBM Corporation:** IBM provides finance cloud services focused on data analytics, artificial intelligence (AI), and blockchain technology for financial institutions.

- **Microsoft Corporation:** Microsoft's finance cloud offerings include Dynamics 365 Finance and Dynamics 365 Business Central, which cater to various financial management needs of organizations.

- **SAP SE:** SAP is a key player in the finance cloud market, offering cloud-based ERP solutions, such as SAP S/4HANA Finance, for streamlined financial operations.

The global finance cloud market is witnessing significant growth due to the increasing adoption of cloud technology across various industries. The deployment of finance cloud solutions in public, private, and hybrid cloud environments provides organizations with flexibility, scalability, and cost savings. Additionally, finance cloud services tailored for different enterprise sizes, service models, and end-user industries enable businesses to enhance their financial processes, improve decision-making, and drive digital transformation. Key market players such as Salesforce, Oracle, IBM, Microsoft, and SAP are at the forefront of innovation in the finance cloud space, offering a wide range of solutions to meet the diverse needs of organizations worldwide.

https://www.databridgemarketresearch.com/reports/global-finance-cloud-marketThe global finance cloud market is experiencing a paradigm shift propelled by the rapid adoption of cloud technology, signaling a transformative era for financial services across industries. One notable trend in the market is the convergence of cloud deployment models, with organizations increasingly exploring public, private, and hybrid cloud options to optimize performance, cost-efficiency, and security. This trend underscores the importance of flexibility and scalability in shaping the future landscape of finance cloud solutions, allowing companies to tailor their infrastructure to meet specific business requirements dynamically.

Furthermore, the segmentation of the finance cloud market according to enterprise size reveals a nuanced approach towards catering to the distinct needs of small and medium-sized enterprises (SMEs) and large corporations. SMEs are leveraging finance cloud solutions to enhance operational efficiency and unlock growth opportunities while larger enterprises focus on leveraging cloud technologies to drive innovation, scale their operations, and stay competitive in today's digital economy. This segmentation highlights the diverse applications of finance cloud services across organizational scales and underscores the role of technology in leveling the playing field for businesses of varying sizes.

The service model segmentation of the finance cloud market brings into focus the varied offerings provided by Software as a Service (SaaS), Platform as a Service (PaaS), and Infrastructure as a Service (IaaS). SaaS offers out-of-the-box financial applications, enabling quick deployment and streamlined operations. PaaS caters to organizations seeking customized financial solutions, empowering them to develop tailored applications suiting their unique requirements. IaaS provides the essential infrastructure and resources needed for financial operations, offering a flexible and cost-effective approach to managing IT resources.

In terms of end-user segmentation, verticals such as banking, financial services, insurance, healthcare, retail, manufacturing, and other industries underscore the diverse applications and specialized needs of finance cloud solutions across sectors. Tailored cloud solutions that address the specific financial requirements of each industry vertical enable businesses to drive digital transformation, enhance customer experiences, and gain a competitive edge in a rapidly evolving marketplace.

The market players' landscape in the finance cloud industry is characterized by the innovation and leadership demonstrated by key players such as Salesforce, Oracle, IBM, Microsoft, and SAP. These market leaders are at the forefront of driving technological advancements in finance cloud solutions, offering a comprehensive suite of services that cater to diverse business needs. Their robust offerings, spanning CRM, ERP, data analytics, AI, and blockchain technology, underscore their commitment to delivering cutting-edge solutions that empower organizations to navigate the complexities of modern finance seamlessly.

In conclusion, the global finance cloud market presents a dynamic landscape shaped by evolving deployment models, enterprise size considerations, service model diversification, and end-user specialization. With an emphasis on flexibility, scalability, and innovation, finance cloud solutions are poised to revolutionize financial services across industries, providing organizations with the tools they need to thrive in an increasingly digital world. As market players continue to drive technological advancements and address the evolving needs of businesses, the finance cloud market is set for sustained growth and transformation in the foreseeable future.**Segments**

- Global Finance Cloud Market, By Type (Solution, Service), Application (Revenue Management, Wealth Management System, Account Management, Customer Management, Others), Deployment Model (Public Cloud, Private Cloud, Hybrid Cloud), Sub-Industry (Banking and Financial Services, Insurance), Organization Size (Small Enterprises and Medium Enterprises, Large Enterprises), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa) Industry Trends and Forecast to 2028.

The Global Finance Cloud Market is witnessing substantial growth and transformation driven by the rapid adoption of cloud technologies across various industries. The segmentation based on different factors like deployment models, enterprise sizes, service models, and end-user industries provides valuable insights into the market dynamics and trends.

The convergence of public, private, and hybrid cloud deployment models signifies a shift towards optimizing performance, cost-efficiency, and security in finance cloud solutions. Organizations are increasingly exploring these deployment options to tailor their infrastructure according to their business requirements dynamically. This trend highlights the importance of flexibility and scalability in shaping the future landscape of finance cloud solutions, enabling companies to enhance operational efficiency and drive innovation.

The segmentation based on enterprise size showcases a nuanced approach to meeting the distinctive needs of SMEs and large corporations. SMEs are embracing finance cloud solutions to enhance efficiency and unlock growth prospects, while larger enterprises are leveraging cloud technologies to drive innovation, scale operations, and maintain competitiveness in the digital economy. This differentiation emphasizes the diverse applications of finance cloud services across organizational scales, leveling the playing field for businesses of varying sizes in the competitive market landscape.

Service model segmentation brings into focus the diverse offerings of SaaS, PaaS, and IaaS in the finance cloud market. SaaS provides ready-to-use financial applications for quick deployment and streamlined operations, whereas PaaS caters to organizations seeking customized solutions for unique requirements. IaaS offers essential infrastructure and resources for financial operations, delivering a flexible and cost-effective approach to managing IT resources efficiently.

End-user segmentation across industries like banking, financial services, insurance, healthcare, retail, manufacturing, and others underscores the specialized needs and applications of finance cloud solutions in different sectors. Tailored cloud solutions addressing specific financial requirements for each industry vertical enable businesses to drive digital transformation, enhance customer experiences, and gain a competitive edge in the evolving marketplace.

The market players such as Salesforce, Oracle, IBM, Microsoft, and SAP drive innovation and leadership in the finance cloud industry, offering a wide range of services catering to diverse business needs. These key players are pioneering technological advancements in finance cloud solutions, highlighting their commitment to delivering cutting-edge services empowering organizations to navigate the complexities of modern finance seamlessly.

In conclusion, the global finance cloud market is poised for sustained growth and transformation, driven by evolving deployment models, enterprise size considerations, service model diversification, and end-user specialization. With a focus on flexibility, scalability, and innovation, finance cloud solutions are set to revolutionize financial services across industries, providing organizations with the tools necessary to thrive in the digital era. As market players continue to push technological boundaries and address evolving business needs, the finance cloud market will witness further growth and transformation in the foreseeable future.

Key Coverage in the Finance Cloud Market Report:

- Detailed analysis of Finance Cloud Market by a thorough assessment of the technology, product type, application, and other key segments of the report

- Qualitative and quantitative analysis of the market along with CAGR calculation for the forecast period

- Investigative study of the market dynamics including drivers, opportunities, restraints, and limitations that can influence the market growth

- Comprehensive analysis of the regions of the Finance Cloud industry and their futuristic growth outlook

- Competitive landscape benchmarking with key coverage of company profiles, product portfolio, and business expansion strategies

Table of Content:

Part 01: Executive Summary

Part 02: Scope of the Report

Part 03: Global Finance Cloud Market Landscape

Part 04: Global Finance Cloud Market Sizing

Part 05: Global Finance Cloud Market Segmentation by Product

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

Browse Trending Reports:

Foundry Binders Market Size, Share and Trends

Diabetic Gastroparesis Treatment Market Size, Share and Trends

Dentinogenesis Imperfecta Type 2 Market Size, Share and Trends

Dicing Tapes Market Size, Share and Trends

Baby Powder Market Size, Share and Trends

Ovarian Cyst Management Market Size, Share and Trends

Craft Beer Food Market Size, Share and Trends

Magnetic Refrigeration Market Size, Share and Trends

Cloud Security Market Size, Share and Trends

Glucometer Market Size, Share and Trends

Non-Destructive Testing Equipment Market Size, Share and Trends

Wood Adhesives Market Size, Share and Trends

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Comments

0 comment