views

Australia Superannuation Market Overview

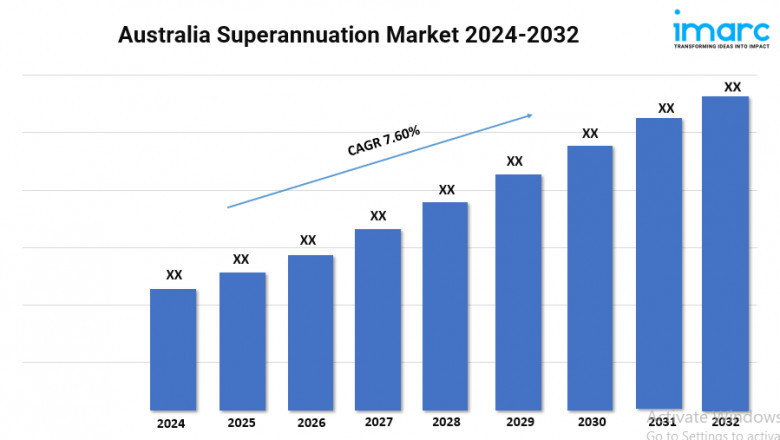

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 7.60% (2024-2032)

The sector showcases robust growth driven by evolving regulations, innovative investment strategies, and a focus on long-term wealth creation. According to the latest report by IMARC Group, the Australia superannuation market size reached USD 3.7 trillion in 2023. Looking forward, IMARC Group expects the market to reach USD 7.4 trillion by 2032, exhibiting a growth rate (CAGR) of 7.60% during 2024-2032.

Download a sample copy of the Report: https://www.imarcgroup.com/australia-superannuation-market/requestsample

Australia Superannuation Industry Trends and Drivers:

The Australia superannuation market has changed a lot in recent years. This shift comes from new rules, advancements in technology, and evolving consumer expectations. Consolidating super funds is a clear trend. APRA wants better performance and lower fees, so this push is gaining momentum. Mergers have caused a big change in the market. While the number of funds has halved in the last ten years, their size and efficiency have increased. Now, larger super funds are taking more market share. This trend of consolidation will likely keep going. It boosts returns and lowers costs for members. Diversifying into environmental, social, and governance (ESG) investing is becoming more important. Super funds are using ESG criteria in their investment strategies. This helps them offer sustainable and ethical options to their members. It's a moral business, but it also makes financial sense. ESG investments have performed well during market turmoil. Digital platforms and robo-advisors are making financial advice more accessible.

A big trend in Australia superannuation market is retirement income solutions. This comes as people age and live longer. Super funds aimed for wealth growth based on established practices. Now, people need something different: products that offer steady income in retirement. New annuities and custom drawdown strategies help retirees handle longevity risk. They also support maintaining a comfortable lifestyle. The government's Retirement Income Covenant now requires funds to make plans. These plans should support members' retirement income. This change is pushing the transformation even more. Technology plays a key role here. It uses data analytics and artificial intelligence to offer personalized retirement planning. Debate is ongoing about superannuation guarantee (SG) rates. They will rise to 12% by 2025. This change could boost retirement savings. But, it may also worry some about wage growth. Young members, especially millennials and Gen Z, are changing the market. They attract funds through strong digital engagement and a focus on ethical investments.

Australia Superannuation Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Australia superannuation market share. It includes forecasts for the period 2024-2032 and historical data from 2018-2023 for the following segments.

The report has segmented the market into the following categories:

Types of Superannuation Funds Insights:

- Industry Funds

- Retail Funds

- Corporate Funds

- Others

Investment Strategy Insights:

- Growth Funds

- Balanced Funds

- Conservative Funds

- Cash and Fixed Interest Funds

- Others

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Competitive Landscape:

The competitive landscape of the industry has also been examined, along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current, and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

Street: Morgan Park QLD 4370

City/Town: Warwick

State/Province/Region: Queensland

Country: Australia

Zip/Postal Code: 4370

Email: sales@imarcgroup.com

Phone Number: +1-631-791-1145

Comments

0 comment