views

Australia Smartphone Market Overview

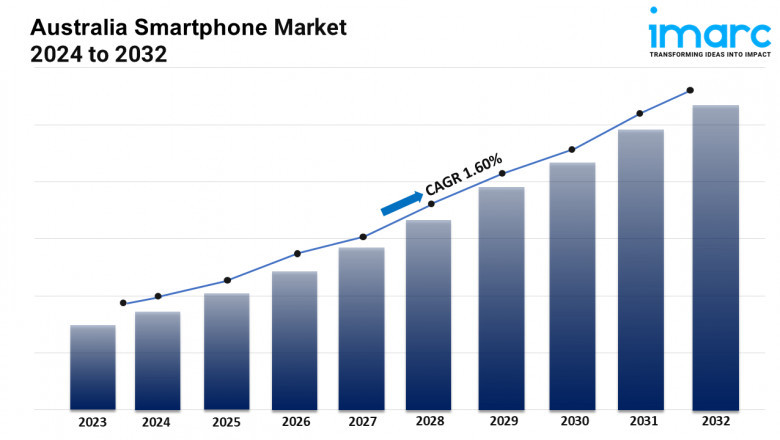

Market Size in 2024: 30.3 Million Units

Market Forecast in 2033: 34.8 Million Units

Market Growth Rate: 1.54% (2025-2033)

According to the latest report by IMARC Group, the Australia smartphone market size reached 30.3 Million Units in 2024. Looking forward, IMARC Group expects the market to reach 34.8 Million Units by 2033, exhibiting a growth rate (CAGR) of 1.54% during 2025-2033.

Australia Smartphone Industry Trends and Drivers:

Mobile technology and connectivity advancements are considered the backdrop behind the growth of the Australian smartphone market. With the launch of high-speed 5G networks throughout the country providing an improved smartphone experience with faster internet, better video quality, an immersive online experience, and all, consumers are now opting to upgrade to smartphones capable of these advanced facilities. Rising mobile applications, especially in entertainment, e-commerce, and finance, are keeping smartphone usage highly relevant as they now assist Australians in day-to-day activities. This transformation in consumer behavior further creates sustained demand for smartphones, specifically for those with cutting-edge features like OLED display technology and high RAM capacity. While 5G has just begun to offer opportunities for the smartphone market, a major expansion is at hand.

Pricing strategy is also a significant determinant of the Australian smartphone market. Several price segments, ranging from ultra-low-end models to premium and ultra-premium smartphones, are allowing consumers to find products that suit their budgets and needs. Price category diversity, including low-end models priced below $200, mid-range alternatives between $200 and $400, and high-end items priced above $600, permits manufacturers to capture wider market segments. Consumers are becoming price-conscious, thereby looking for value-for-money devices, which has led manufacturers to enhance features for all price points. This style is noticed most among the younger and technologically savvy Australians, who reason more toward performance and design while looking for affordable solutions. Mid-range and premium segments continue to grow, triggering manufacturers to offer more advanced smartphones at compelling price points.

The distribution channels for which smartphones are sold are witnessing rapid changes in Australia. The paradigm of retail is being shaped by increasing online store reliance, as consumers prefer convenience when buying smartphones in the present. This trend is enhanced by the presence of giant e-commerce platforms, with an increasing number of OEMs opting for direct-to-consumer sales. That's why traditional brick-and-mortar stores are still relevant, as many consumers prefer to gather their purchase information in-person before making a buying decision. The omnichannel approach, which includes both online and offline, ensures access for every type of customer. With an increasing proportion of the consumer base pursuing personalized shopping experiences, we can expect an expansion of access to smartphones through a diversity of distribution channels, hence accelerating the growth of the Australian smartphone market.

Download sample copy of the Report: https://www.imarcgroup.com/australia-smartphone-market/requestsample

Australia Smartphone Industry Segmentation:

The report has segmented the market into the following categories:

Operating System Insights:

- Android

- iOS

- Others

Display Technology Insights:

- LCD Technology

- OLED Technology

RAM Capacity Insights:

- Below 4GB

- 4GB - 8GB

- Over 8GB

Price Range Insights:

- Ultra-Low-End (Less Than $100)

- Low-End ($100-<$200)

- Mid-Range ($200-<$400)

- Mid- to High-End ($400-<$600)

- High-End ($600-<$800)

- Premium ($800-<$1000) and Ultra-Premium ($1000 and Above)

Distribution Channel Insights:

- OEMs

- Online Stores

- Retailers

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=21977&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Comments

0 comment