Despite a 14.32% gain over the last 30 days, Stellar’s medium-term trend remains bearish, with a -13.85% loss in the past 3 months. However, the long-term picture still holds strength, as the token is up an impressive 164.02% year-on-year — trading at just $0.106746 this time last year.

Recent market activity, however, suggests mounting bearish momentum. According to Santiment data, XLM’s Open Interest — a measure of active derivatives contracts — has declined for six consecutive days, dropping from $49 million to $38 million. This fall indicates that investors are stepping back, closing positions, and hesitating to open new ones.

Also Read: AIOZ Network Price Prediction 2025 - 2030

Compounding the negative outlook, XLM’s funding rate has slipped into negative territory. A negative funding rate implies that short positions are dominant, and traders are increasingly betting on price declines. This reinforces the growing bearish sentiment surrounding the token.

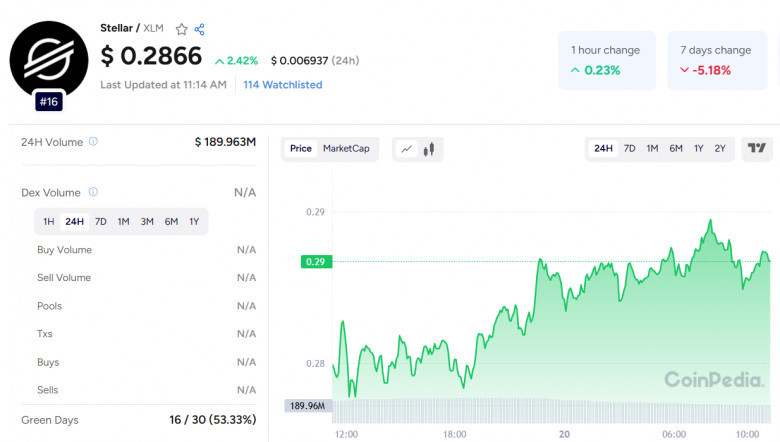

Respected crypto analyst Ali Martinez has cautioned that XLM must hold the $0.27 support level to avoid deeper losses. If this level fails, a drop to $0.23 is likely. This aligns with technical signals suggesting that market participants are preparing for further downside.

In summary, while Stellar has shown strong long-term performance, current metrics reflect growing selling pressure and market hesitation. With Open Interest declining and short positions rising, XLM holders should monitor support levels closely and remain cautious in the short term.