views

Unfiled Tax Returns and Payroll Tax Troubles in New York: What You Need to Know

Let’s face it — dealing with taxes isn’t exactly a walk in Central Park. Whether it’s forgetting to file your tax returns or getting tangled in payroll tax issues, the consequences can pile up fast. Imagine your taxes like a closet you’ve avoided for years. At first, it’s just a few papers. But soon, it’s overflowing — and opening it without help can feel overwhelming.

This article walks you through how to handle unfiled tax returns in New York, payroll tax issues, and how a New York tax defense attorney, IRS lawyer NYC, or criminal tax attorney can step in to help. Ready to untangle that tax mess? Let’s begin.

What Are Unfiled Tax Returns?

Unfiled tax returns are simply returns that were due but never submitted. Whether by accident or avoidance, missing even one year of filing can create major legal and financial problems. This is especially serious in a place like New York, where both the IRS and state tax agencies are aggressive in collection and enforcement. The longer you delay, the more you risk penalties, audits, and even criminal investigation.

Why People Avoid Filing Taxes

There are many reasons why someone might skip filing. Some are afraid they’ll owe money they can’t pay. Others feel overwhelmed by the paperwork or don’t understand their obligations. Life events like divorce, illness, or business struggles also push filing down the priority list. But tax problems rarely disappear on their own. Addressing them early is far less painful than waiting until enforcement actions begin.

Consequences of Unfiled Tax Returns

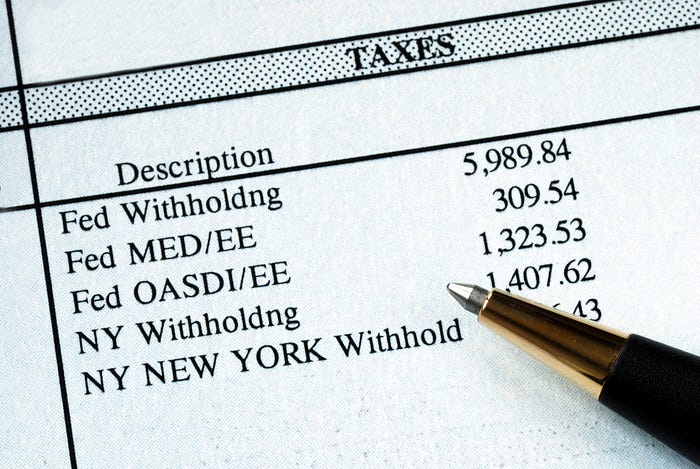

Failing to file your tax returns can lead to serious consequences. Penalties and interest begin accumulating immediately. Worse, the IRS or New York State may file a “substitute return” for you, which won’t include credits or deductions. If they believe your non-filing was deliberate, you may be charged with tax evasion — a criminal offense. Refunds you may have been entitled to could also be lost forever if too much time passes.

How to Fix Unfiled Tax Returns in New York

If you’ve fallen behind, don’t panic — but do act quickly. Start by collecting your income documents such as W-2s or 1099s. If you’re missing any, you can request transcripts from the IRS. Once your records are complete, file the past-due returns, ideally with the help of a tax professional. You may also qualify for installment plans or even settlement programs depending on your financial situation.

A seasoned New York tax defense attorney can make this process smoother and prevent further enforcement actions.

Who is a New York Tax Defense Attorney?

A New York tax defense attorney is a legal professional specializing in tax law, particularly cases involving disputes with the IRS or the New York Department of Taxation and Finance. These attorneys defend clients facing audits, collections, criminal tax allegations, and other tax-related penalties. Their deep understanding of local and federal tax laws allows them to negotiate favorable outcomes and protect clients’ rights during investigations.

Common Payroll Tax Issues in New York

Running a business comes with payroll responsibilities, and overlooking them can be costly. Business owners often get into trouble when they miss tax deposits, misclassify employees as contractors, or withhold taxes from employees but fail to forward them to the IRS or state. These problems can spiral quickly, leading to trust fund recovery penalties and even criminal charges. Addressing them early is key.

The Role of a Payroll Tax Lawyer

A payroll tax lawyer is essential when your business has tax issues related to employee compensation. These legal professionals help you interpret and comply with complex employment tax laws. They negotiate on your behalf with the IRS and can represent you in audits or court proceedings. If your business is already behind on payments, a lawyer can help you avoid further penalties and possibly save your business from closure.

Signs You Need the Best Payroll Tax Lawyer

There are a few clear indicators that it’s time to consult the Best Payroll Tax Lawyer New York. If your business has received letters from the IRS or the New York State Department of Taxation, that’s your first red flag. Other signs include missed payroll deposits, an upcoming audit, or a mounting tax bill you can’t afford to pay. Don’t wait until the IRS freezes your accounts or begins asset seizure. A lawyer can help you before it’s too late.

IRS Audits & Why You Need a Lawyer

An IRS audit can feel like a magnifying glass on every financial decision you’ve made. Auditors will review your records in detail and may question your deductions, income, and business expenses. While you’re not legally required to have representation, having an IRS lawyer NYC ensures that you don’t inadvertently provide damaging information. These lawyers understand what the IRS can and can’t demand, and they make sure you’re treated fairly throughout the process.

What an IRS Lawyer in NYC Can Do for You

An IRS lawyer NYC offers a layer of protection and guidance during your dealings with the IRS. Whether you’re facing an audit, collections, or negotiating for tax debt relief, they know the best strategies to minimize the financial and legal impact. These attorneys can file legal motions, contest tax bills, and even represent you in U.S. Tax Court if it comes to that. They’re not just advisors — they’re advocates.

Criminal Tax Charges: What to Know

When tax issues escalate into criminal charges, the stakes become much higher. This can happen when the IRS or state believes your failure to file or pay taxes was intentional. Charges may include tax evasion, filing false returns, or payroll tax fraud. Criminal convictions can result in steep fines, asset forfeiture, and even imprisonment. It’s not just about money anymore — it’s about your freedom.

How a NYC Criminal Tax Attorney Helps

A New York City criminal tax attorney is your strongest ally when you’re facing criminal investigation or prosecution. These lawyers defend your rights, challenge evidence, negotiate with prosecutors, and help build a strong defense. Whether it’s avoiding charges or reducing the severity of penalties, their role is critical. If you’re under investigation, speaking to an attorney right away — before making any statements — can be the most important decision you make.

Voluntary Disclosure Programs

Voluntary disclosure programs offer a second chance for taxpayers who want to come clean. Both the IRS and New York offer options for individuals and businesses to self-report tax issues before enforcement begins. By doing so, you may avoid criminal prosecution and benefit from reduced penalties. These programs are especially useful for those with unfiled tax returns or previously undeclared income. A tax attorney can help you prepare and submit the necessary documents.

Choosing the Right Tax Attorney in NY

Finding the right lawyer might feel overwhelming, but it’s crucial. Look for an attorney who specializes in tax law and has experience with the specific issues you’re facing. A good tax defense attorney will take the time to understand your situation, explain your options, and fight to get you the best outcome possible. Don’t settle for someone who just dabbles in tax law — you need a specialist.

Final Tips to Stay Tax Compliant

Staying compliant with taxes doesn’t require perfection — just consistency and attention. File your taxes on time each year, even if you can’t afford to pay in full. Keep your financial records organized and up to date. If you run a business, make sure your payroll taxes are handled accurately and on time. Finally, don’t ignore IRS or state notices. Early action almost always leads to better outcomes.

Conclusion

Taxes might be a certainty in life, but tax problems don’t have to be. Whether you’re dealing with unfiled tax returns new york, overwhelmed by payroll tax liabilities, or facing a criminal investigation, you have options — and experts who can help. A trusted New York tax defense attorney, IRS lawyer NYC, or New York City criminal tax attorney can be your greatest asset in getting your finances and peace of mind back on track. Don’t let fear keep you from taking the first step. The right help is out there — reach for it.

FAQs

1. What happens if I don’t file my taxes in New York?

You may face penalties, interest, substitute returns, loss of refunds, or even criminal prosecution depending on the length and intent behind the non-filing.

2. How do I choose the Best Payroll Tax Lawyer New York?

Seek someone with a strong record in employment tax law, transparent pricing, good client reviews, and a clear explanation of your options during the initial consultation.

3. Can an IRS lawyer in NYC help me avoid tax penalties?

Yes. IRS lawyers can negotiate for reduced penalties, request abatement, and represent you in settlements or court if needed.

4. When should I hire a New York City criminal tax attorney?

If you are being investigated or charged with tax crimes like evasion, fraud, or willful failure to file, hire a criminal tax attorney immediately.

5. Can I fix unfiled tax returns in New York without going to jail?

Yes. Many cases can be resolved without criminal penalties, especially if you act early and use voluntary disclosure programs with guidance from a tax defense attorney.