views

Microwave Devices Market Estimated to Witness Growth Owing to GaN Technology

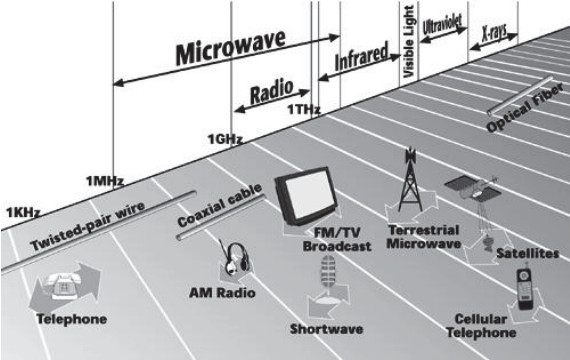

Microwave devices encompass a broad array of components—such as amplifiers, oscillators, filters, transceivers, and waveguides—designed to operate at frequencies between 300 MHz and 300 GHz. These products deliver high power efficiency, low noise, compact footprints, and robust performance under extreme temperatures, making them indispensable in radar systems, satellite communications, aerospace & defense, medical imaging, and automotive radar applications.

As the demand for higher data throughput and reliable connectivity escalates, the need for advanced Microwave Devices Market solutions has surged. GaN-based semiconductor technology further enhances device reliability and power density, which drives market growth and expands market share across various industry segments. Continuous innovation in packaging, integration, and thermal management also supports market growth strategies, addressing market challenges such as miniaturization and heat dissipation. Improved market insights and market research underscore escalating demand for next-generation telecom infrastructure, Internet of Things (IoT) devices, and 5G networks.

The microwave devices market is estimated to be valued at USD 8.94 Bn in 2025 and is expected to reach USD 13.53 Bn by 2032, growing at a compound annual growth rate (CAGR) of 6.1% from 2025 to 2032.

Key Takeaways

Key players operating in the Microwave Devices Market are:

-Analog Devices, Inc.

-Teledyne Technologies

-Texas Instruments

-L3 Harris Technologies, Inc.

-Honeywell International Inc.

These market players are actively strengthening their market positions through strategic collaborations, new product launches, and targeted acquisitions to capture industry share in both civilian and defense segments.

Significant market opportunities lie in the rapid expansion of 5G infrastructure, satellite broadband services, and Industry 4.0 deployments. As telecom operators roll out high-bandwidth, low-latency networks, microwave components must meet stringent performance requirements, presenting lucrative market opportunities. In aerospace and defense, rising defense budgets and modernization initiatives drive demand for rugged, high-frequency solutions. Automotive radar for advanced driver-assistance systems (ADAS) and autonomous vehicles is another high-growth segment, underpinned by stringent safety regulations and consumer demand for connected mobility. Additionally, growing adoption of microwave imaging in healthcare for non-invasive diagnostics and security scanning at transportation hubs further broadens the market scope. These market trends and industry growth segments signal robust market revenue potential through 2032.

Technological advancement in GaN-based Semiconductor Technology is reshaping the microwave devices landscape. GaN transistors offer higher electron mobility, improved thermal conductivity, and greater power density compared to legacy silicon LDMOS devices. This advancement drives enhanced device reliability, extended operational lifespans, and reduced system-level costs by enabling smaller heat sinks and simpler cooling solutions. Continuous research and development in GaN MMIC (monolithic microwave integrated circuit) design is fueling next-generation high-frequency amplifiers and compact transceivers. Integration of GaN with advanced packaging techniques accelerates time-to-market for new applications in satellite payloads, 5G base stations, and high-power radar, highlighting critical market dynamics and affirming GaN’s role as the technological cornerstone for future microwave device innovations.

Market Drivers

One of the primary market drivers is the surging demand for high-frequency communication infrastructure fueled by 5G network deployment and the push toward data-intensive applications. As telecom operators worldwide invest in macro cell and small cell rollouts, microwave backhaul and fronthaul equipment become indispensable to ensure seamless connectivity and low-latency transmission. Microwave devices with GaN semiconductor technology deliver the necessary power efficiency and frequency stability to support mmWave bands, which are crucial for ultra-fast mobile broadband and fixed wireless access. Furthermore, defense modernization programs across North America, Europe, and the Asia Pacific region drive procurement of advanced radar and electronic warfare systems, which rely heavily on high-performance microwave components. The convergence of commercial and defense requirements amplifies demand for devices exhibiting high reliability, wide bandwidth, and compact form factors. This heightened requirement for enhanced system capabilities not only propels market growth but also encourages continuous innovation and higher R&D spending, further strengthening the market forecast.

Current Challenges in the Microwave Devices Market

The microwave devices industry is navigating several critical market challenges that influence its competitive landscape and overall business growth. One major hurdle is supply chain volatility, where semiconductor and rare‐earth component shortages have intensified production delays. This restraint has a direct impact on market share as manufacturers compete for limited resources. Regulatory complexity represents another key challenge: differing certification requirements across regions slow time-to-market and increase compliance costs. Addressing environmental and safety standards further tightens production margins, forcing companies to invest in new testing protocols and eco-friendly materials.

Rapid technological evolution also presents a dual-edged sword. While advancing integration and miniaturization unlock fresh market opportunities, legacy systems struggle to keep pace, pushing some end-users to postpone upgrades. Interoperability issues between next-generation microwave modules and existing platforms exacerbate this fragmentation. Moreover, pricing pressure from emerging low-cost players in adjacent markets has intensified competition, eroding average selling prices and constraining revenue growth. Finally, the fragmentation of demand across defence, telecommunications, and industrial segments creates uneven capacity utilization, making it harder for suppliers to predict production volumes and optimize manufacturing efficiency.

SWOT Analysis

Strength: The microwave devices market benefits from strong technological foundations in high-frequency design and robust R&D capabilities, enabling rapid innovation in components and subsystems for radar, satellite, and wireless applications.

Weakness:

• High production complexity and rigorous quality requirements drive up manufacturing costs, placing pressure on profit margins and limiting price flexibility.

• Dependence on specialized raw materials and advanced fabrication facilities can lead to bottlenecks, reducing responsiveness to sudden spikes in customer demand.

Opportunity:

• Growing adoption of 5G and beyond-5G communications offers substantial market opportunities, as operators demand compact, energy-efficient modules to enable improved network throughput and coverage.

• Expansion of autonomous vehicles and unmanned aerial systems creates new application segments, fostering collaboration between industry players and tier-1 system integrators.

Threats:

• Escalating geopolitical tensions may trigger export controls on critical components, disrupting cross-border supply chains and limiting access to strategic markets.

• Competitive pressure from silicon-based and GaN-on-SiC alternatives threatens established gallium arsenide technologies, potentially cannibalizing traditional revenue streams.

Geographical Regions by Value Concentration

The microwave devices market exhibits significant value concentration in North America and Europe. North America, led by advanced aerospace, defence, and telecom sectors, commands a large portion of market share due to high-end radar systems and satellite communications deployments. Europe follows closely, with key industrial hubs in Germany, the UK, and France driving demand for industrial automation and public safety networks. In both regions, stringent quality standards and well-funded R&D centers bolster market insights—spurring innovation in high-power amplifiers and tunable filters. These mature markets benefit from established supply chains and supportive government programs, fostering stable demand for both custom and off-the-shelf modules.

Fastest-Growing Region

Asia-Pacific has emerged as the fastest growing region for microwave devices, fueled by rapid 5G rollouts, expanding defense budgets, and surging domestic electronics manufacturing. China, South Korea, and Japan are investing heavily in next-generation wireless infrastructure, driving unprecedented market growth in high-frequency front-end modules. Southeast Asian nations, including India, Malaysia, and Vietnam, are leveraging attractive investment incentives to build semiconductor fabs and assembly lines, accelerating local production capacity. Rising demand for smart cities, IoT platforms, and satellite broadband services further propels regional momentum. Together, these factors create fertile ground for business growth and new market opportunities across the APAC landscape.

‣ Get this Report in Japanese Language: マイクロ波デバイス市場

‣ Get this Report in Korean Language: 마이크로파장치시장

About Author:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191)