views

Industrial Valves Market to Soar with IoT-Enabled Automation

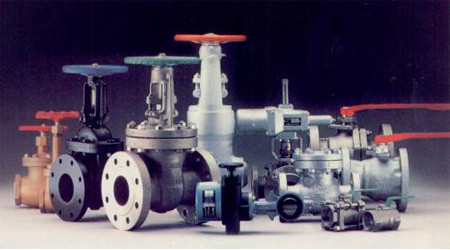

The industrial valves market encompasses a broad array of flow-control devices—gate, globe, ball, butterfly, and check valves—designed to regulate pressure, temperature, and flow in processes ranging from oil & gas pipelines to water treatment and chemical manufacturing. These valves deliver precise shutoff, throttling, and directional control, ensuring operational safety, energy efficiency, and compliance with stringent environmental regulations.

As industries pursue digital transformation, smart valves equipped with IoT sensors and advanced actuators enable real-time monitoring, predictive maintenance, and seamless integration with SCADA and cloud-based asset-management platforms. This technological leap not only curtails unplanned downtime and maintenance costs but also enhances productivity and data-driven decision making across plant operations. Growing focus on renewable energy infrastructure, expanding petrochemical capacities in Asia-Pacific, and the refurbishment of aging industrial assets further amplify the need for reliable, high-performance Industrial Valves Market.

The industrial valves market is estimated to be valued at USD 86.74 Bn in 2025 and is expected to reach USD 201.55 Bn by 2032. It is estimated to grow at a compound annual growth rate (CAGR) of 12.8% from 2025 to 2032.

Key Takeaways

Key players operating in the Industrial Valves Market are:

-Avcon Controls Private Limited

-AVK Holding A/S

-Crane Co.

-Metso Corporation

-Schlumberger Limited

These market players leverage extensive R&D capabilities, strategic partnerships, and acquisitions to broaden product portfolios across key segments—oil & gas, power generation, water & wastewater—and geographies. Their focus on aftermarket services and digital solutions supports business growth, bolsters market share, and strengthens competitive positioning in an evolving industry landscape.

The market presents significant opportunities driven by process optimization initiatives, stringent environmental norms, and the global push for decarbonization. Growing investments in water infrastructure and renewable energy projects, especially in emerging economies, create fresh revenue streams. Demand for retrofit solutions in refineries and petrochemical plants offers lucrative refurbishment contracts. Additionally, the rising adoption of condition-based maintenance and centralized valve management solutions opens new avenues for service-oriented offerings.

IoT-enabled automation remains a pivotal technological advancement reshaping the industrial valves landscape. Smart valves integrate sensors, edge computing, and digital twins to provide real-time diagnostics, remote control, and AI-driven predictive analytics. By leveraging these innovations, operators achieve improved asset utilization, reduced energy consumption, and enhanced safety compliance. This technology trend aligns with Industry 4.0 mandates and drives new standards in operational transparency and process reliability.

Market Drivers

One of the primary market drivers is the accelerated adoption of automation and digitalization across process industries. Operators increasingly demand valves with embedded IoT sensors and smart actuators to enable continuous condition monitoring, data logging, and analytics. This enhances predictive maintenance strategies, minimizing unscheduled shutdowns and optimizing spare-parts inventory—key factors in reducing total cost of ownership. Furthermore, stricter environmental and safety regulations worldwide mandate precise flow control and leak detection, elevating the role of high-integrity valves in hazardous applications. The shift toward energy-efficient operations and carbon-reduction targets further fuels investment in intelligent valve solutions that support real-time performance tracking and adaptive control. Together, these factors underpin sustained market growth and underscore the critical importance of advanced valve technologies in modern industrial ecosystems.

Market Challenges, SWOT Outlook, and Regional Distribution

The Industrial Valves Market faces a host of operational and strategic challenges as it seeks to meet growing demand across various end-use industries. Supply chain disruptions and fluctuating raw material costs remain significant market constraints and can impede business growth by inflating production expenses. Regulatory compliance requirements, particularly stringent safety and environmental standards, introduce complexity into valve design processes and testing protocols. Meanwhile, rapid shifts in market dynamics driven by digitalization have increased pressure on manufacturers to adopt smart valve solutions and predictive maintenance systems, demanding hefty capital investments. Additionally, the segment remains sensitive to geopolitical tensions and trade policies that can curtail global shipments and restrict access to emerging markets, adversely affecting overall market growth strategies and market share objectives. Finally, an acute shortage of skilled technicians and engineers capable of operating advanced valve assemblies further hinders smooth scaling, posing a direct market restraint and evolving market drivers.

A high-level SWOT outlook reveals both stabilizing factors and areas of vulnerability. On the strength side, established players enjoy robust after-sales service networks and proven technology portfolios that bolster industry reputation. Conversely, certain producers face rising cost pressures and legacy infrastructure limitations that may slow innovation cycles. Opportunities abound in extending valve applications into renewable energy and water management sectors, where rising investment in sustainable infrastructure generates new market opportunities. Threats lurk in the form of disruptive digital entrants and alternative fluid control mechanisms that can erode traditional valve revenue streams. Tailored market research and market insights will be critical in navigating these forces and aligning growth strategies with evolving customer requirements.

Geographically, demand for industrial valves is heavily concentrated in mature regions that account for the lion’s share of industry revenue. North America and Western Europe remain pivotal hubs, driven by petrochemical plants, oil and gas operations, and aging infrastructure requiring frequent replacements. Simultaneously, the Asia Pacific region has emerged as a rapidly evolving segment, buoyed by large-scale infrastructure projects, burgeoning power generation capacities, and expanding chemical throughput. LatAm and Middle East & Africa markets contribute a smaller slice of total industry output but exhibit unique niche applications in mining and water treatment. These geographic segments are defined by varying degrees of market segmentation and regional market drivers, with distinct supply-demand profiles and diverse regulatory landscapes. Recognizing regional market trends is essential for shaping effective market growth strategies and identifying local competitive advantages.

Current Challenges in the Industry

In the Industrial Valves industry today, several immediate challenges define operational priorities and strategic agendas. Supply chain volatility remains at the forefront: suppliers of alloys and critical elastomers struggle to meet just-in-time demands, leading to production bottlenecks. This instability underscores the importance of comprehensive market research to forecast potential disruptions and develop contingency plans. Meanwhile, the transition toward smart valve technologies introduces technological hurdles as manufacturers must integrate sensors, actuators, and digital communication protocols without compromising reliability. Balancing costs associated with digital retrofits against long-term maintenance savings poses a significant decision point for many operators. Environmental regulations have grown more stringent, placing additional burdens on valve producers to validate compliance through detailed testing and certification processes. These regulatory requirements not only elevate production expenses but also prolong time-to-market for new models. Furthermore, the skilled labor shortage presents an ongoing operational challenge, with many facilities reporting gaps in technical expertise needed for calibration, installation, and troubleshooting. Training initiatives and partnerships with technical institutes are becoming crucial to mitigate this restraint. Collectively, these challenges call for coordinated market growth strategies and proactive risk management to sustain competitive advantage and drive business growth.

SWOT Analysis

Strength: Established valve manufacturers benefit from deep expertise in metallurgy and fluid mechanics, coupled with extensive global service networks that ensure rapid aftermarket support and cement long-standing customer relationships. This robust technical foundation underpins ongoing market growth.

Weakness: Legacy production facilities often lack the flexibility to adapt to customized, low-volume orders, resulting in longer lead times and higher per-unit costs. In addition, limited digital capabilities in some firms hinder their ability to offer predictive maintenance solutions, reducing competitiveness in smart valve segments.

Opportunity: Rising investments in renewable energy infrastructure and water treatment projects present avenues for valve providers to diversify portfolios and tap into new market opportunities. Moreover, the adoption of Industry 4.0 technologies creates a significant opportunity to develop smart valves equipped with sensors and real-time monitoring, driving enhanced operational efficiency.

Threats: Intensifying competition from low-cost regional players can erode market share and pressure margins, particularly in emerging markets. Additionally, the potential for disruptive technologies—such as additive manufacturing and alternative fluid control methods—poses a risk of rendering conventional valve designs obsolete if incumbents fail to innovate.

Regional Value Concentration

In terms of absolute value, the Industrial Valves Market is predominantly concentrated in North America, Western Europe, and the Asia Pacific region, collectively accounting for a substantial portion of global market share and market revenue. North America leads with its extensive petrochemical and oil and gas infrastructure, creating robust demand for high-performance control and isolation valves. The United States, in particular, boasts a mature industrial base that emphasizes aftermarket services and advanced customization. Western Europe follows closely, driven by stringent safety regulations and a strong focus on sustainable energy, which fuels valve replacements and upgrades in power, chemical, and water treatment sectors. The Asia Pacific region also registers significant value concentration, especially in China and Japan, where rapid industrialization, growing manufacturing output, and large-scale infrastructure projects amplify valve consumption. Together, these three regions shape the competitive landscape, inspiring local and international market players to tailor market growth strategies to regional nuances. Latin America and the Middle East & Africa represent smaller slices of overall value but maintain strategic importance in niche segments such as mining, desalination, and regional pipeline development. Understanding these geographic concentrations is essential for businesses seeking to allocate resources effectively and capture sizable market opportunities.

Fastest Growing Region

The Asia Pacific region emerges as the fastest growing segment in the Industrial Valves Market. Fueled by escalating infrastructure investment, burgeoning energy projects, and robust manufacturing expansion, markets in India, China, South Korea, and Southeast Asia are witnessing accelerated valve adoption. Urbanization efforts in Southeast Asia have triggered large-scale water treatment and wastewater management initiatives, driving demand for specialized globe and butterfly valves renowned for their flow control precision. In parallel, China’s Belt and Road infrastructure program has spurred cross-border pipeline and petrochemical projects, opening fresh market opportunities for valve suppliers. India’s push toward electrification and renewable power generation translates into lucrative prospects for high-performance valves in thermal and hydro power plants. Additionally, favorable trade policies, government incentives for local production, and technology transfer partnerships amplify regional market growth. The incorporation of smart grid and automation initiatives—central to Industry 4.0 strategies—further accelerates valve modernization efforts, positioning Asia Pacific as a hotbed for digital retrofit solutions. Intensifying collaboration between domestic manufacturers and global market companies also plays a key role in fostering innovation and local capacity-building, further reinforcing Asia Pacific’s dynamic valve ecosystem and solidifying its market forecast.

‣ Get this Report in Japanese Language: 産業用バルブ市場

‣ Get this Report in Korean Language: 산업용밸브시장

About Author:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191)