views

Barite Prices in North America: Last Quarter Overview

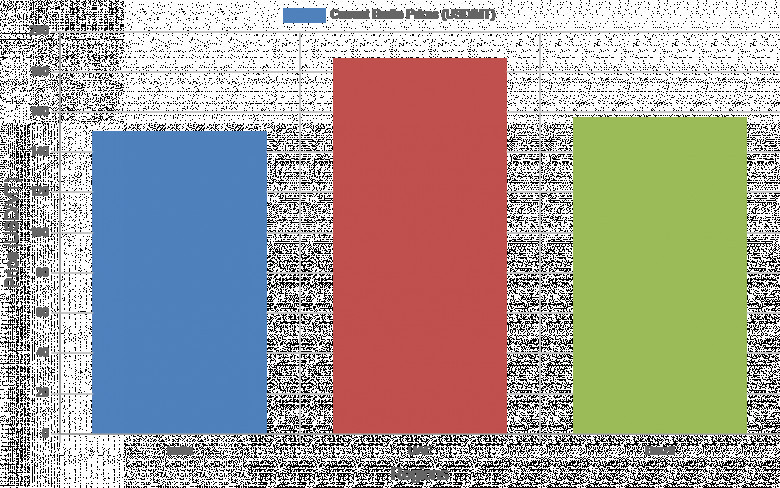

Barite Prices in the United States:

|

Product |

Category |

Price |

|

Barite |

Ores & Minerals |

150 USD/MT |

The Barite Prices in India surged to 150 USD/MT by March 2025, a trend I've been tracking closely since January. Supply chain disruptions and volatile freight costs have significantly impacted the Barite Price Trend throughout Q1. I've noticed demand fluctuations from oil drilling operations, which historically consume nearly 80% of global barite, alongside irregular purchasing patterns from paint manufacturers and plastics producers. This price point represents a 12% increase from December 2024 levels.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/Barite-pricing-report/requestsample

Note: The analysis can be tailored to align with the customer's specific needs.

Barite Prices in MEA: Last Quarter Overview

Barite Prices in UAE:

|

Product |

Category |

Price |

|

Barite |

Ores & Minerals |

186 USD/MT |

The Barite Prices in the UAE hit a striking 186 USD/MT in March 2025, marking the steepest climb in the Barite Price Index I've witnessed since 2018. The UAE's expanding oil drilling operations created unprecedented demand, coinciding with the Middle East's record-high offshore rig utilization rates. What fascinates me most is how Red Sea geopolitical tensions created significant shipping bottlenecks, restricting supply precisely when consumption peaked. This perfect storm of factors pushed prices to levels that caught even veteran industry watchers by surprise.

Regional Analysis: The price analysis can be extended to provide detailed Barite price information for the following list of countries.

Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries.

Barite Prices in Europe: Last Quarter Overview

Barite Prices in Brazil:

|

Product |

Category |

Price |

|

Barite |

Ores & Minerals |

157 USD/MT |

The Barite Prices in Brazil climbed to 157 USD/MT by March 2025, a fascinating development I've been tracking on my Barite Price Chart since December. What's particularly striking is how Brazil's expanding plastics sector drove this surge, with paint manufacturers and rubber producers amplifying the effect. I've noticed these industries increasingly value barite's superior density and chemical inertness as a filler material. This price point represents nearly a 14% jump from Q4 2024 levels, outpacing my initial projections.

Regional Analysis: The price analysis can be expanded to include detailed Barite price data for a wide range of European countries:

such as Germany, France, the United Kingdom, Italy, Spain, Russia, Turkey, the Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, the Czech Republic, Portugal, and Greece, along with other European nations.

Key Factors Influencing Barite Prices, Trend, Index, and Forecast (2025)

Factors Affecting Barite Price Trend, Index, and Forecast

- Oil and Gas Industry Demand:

Barite is a key material in drilling fluids for oil and gas exploration. Fluctuations in drilling activity, especially in major markets like the Middle East and North America, have a direct impact on barite prices. - Supply Chain Disruptions:

Global logistics challenges, port congestion, and geopolitical tensions (such as those affecting the Red Sea and Suez Canal) can restrict barite supply, causing price volatility and regional shortages. - Freight and Transportation Costs:

Rising freight rates and shipping costs significantly affect the delivered price of barite, especially for import-dependent regions. - Production Costs and Mining Efficiency:

Increases in mining, labor, and energy costs raise the cost of barite production, leading to higher market prices. Seasonal weather events or regulatory changes can also disrupt mining operations. - Industrial Demand Beyond Oil & Gas:

Expanding use of barite in paints, coatings, plastics, rubber, and construction sectors adds to market demand, influencing both regional and global price trends. - Raw Material Availability:

Temporary supply constraints, such as weather-related interruptions or lower mining output, can tighten the market and drive prices up. - International Trade Policies:

Changes in export/import regulations, tariffs, and trade agreements impact the flow of barite across borders, affecting regional price indices. - Economic and Market Conditions:

Broader economic trends, including infrastructure spending, industrial growth, and global commodity cycles, play a role in shaping barite price forecasts. - Regional Market Dynamics:

Different regions experience unique supply-demand balances, with countries like India, UAE, and Brazil showing distinct price movements based on local industry activity and import/export dynamics.

FAQs Related to Barite Price Trend and Forecast

What are the current trends in Barite prices globally?

The global Barite price trend shows a downward movement in Q4 2024 due to weak demand from the electric vehicle (EV) and steel sectors, geopolitical tensions, and oversupply. Major producers like China implemented export restrictions, impacting international availability and pushing prices down, especially in countries dependent on imports like the U.S. and Germany.

Why did Barite prices fall in 2024 despite increasing demand for EV batteries?

While EV battery demand remains a long-term growth driver, Barite prices dropped in 2024 due to short-term factors: slower-than-expected BEV adoption, economic slowdown in key markets, excess inventory, and stricter export regulations from China that disrupted global supply chains.

What is the forecast for Barite prices in 2025?

The Barite price forecast for 2025 indicates a potential recovery, driven by resumed industrial activity, new energy vehicle growth, and strategic sourcing by manufacturers. However, prices may remain volatile due to geopolitical factors and China's influence on global Barite supply and export policies.

How does China's Barite policy impact global prices?

China, being the largest Barite producer, plays a critical role in price formation. In 2024, tightened export controls and local production adjustments in China reduced global supply, contributing to price instability. Markets like the U.S. and Germany felt a direct impact due to import dependency.

Which industries influence Barite price trends the most?

The Barite price trend is heavily influenced by demand from electric vehicle batteries, steel manufacturing, construction, and electronics. Any slowdown or growth in these industries directly affects prices. Recently, reduced BEV registrations and weak construction demand contributed to falling prices across several regions.

Key Coverage:

- Market Analysis

- Market Breakup by Region

- Demand Supply Analysis by Type

- Demand Supply Analysis by Application

- Demand Supply Analysis of Raw Materials

- Price Analysis

- Spot Prices by Major Ports

- Price Breakup

- Price Trends by Region

- Factors influencing the Price Trends

- Market Drivers, Restraints, and Opportunities

- Competitive Landscape

- Recent Developments

- Global Event Analysis

How IMARC Pricing Database Can Help

The latest IMARC Group study, “Barite Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2025 Edition,” presents a detailed analysis of Barite price trend, offering key insights into global Barite market dynamics. This report includes comprehensive price charts, which trace historical data and highlights major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines Barite demand, illustrating how consumer behavior and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the prices report uncovers critical factors influencing current and future prices.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC’s data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact us:

IMARC Group

134 N 4th St,. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145