views

North America Base Oil Prices Movement Q3:

Base Oil Prices in the United States:

|

Product |

Category |

Price |

|

Base Oil |

Chemical |

17,156 USD/MT |

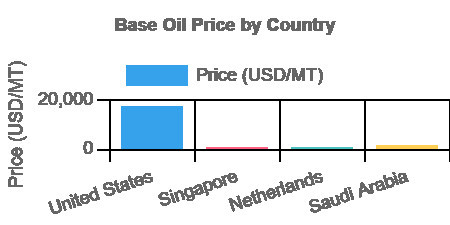

During Q3 2024, the Base Oil Trend in the United States demonstrated a mix of stability and minor fluctuations, with prices peaking at 17,156 USD/MT in September. The market remained steady due to balanced supply and demand dynamics, even as temporary disruptions and a surge in demand in July created short-term price movements. By September, weaker lubricant market demand helped stabilize prices, allowing suppliers to adjust their pricing strategies cautiously. Industry analysts closely tracked Base Oil Pricing Data to assess market resilience and predict future trends, ensuring that pricing adjustments aligned with shifting demand patterns and external economic influences. This period underscored the critical role of base oil demand in sustaining market stability and shaping long-term price trends, reinforcing the importance of strategic supply chain management in navigating evolving industry conditions.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/base-oil-pricing-report/requestsample

Note: The analysis can be tailored to align with the customer's specific needs.

APAC Base Oil Prices Movement Last Quarter:

Base Oil Prices in Singapore:

|

Product |

Category |

Price |

|

Base Oil |

Chemical |

860 USD/MT |

In Q3 2024, Base Oil Prices Forecast Data indicated a decline in base oil prices in Singapore, settling at 860 USD/MT in September. This downward trend was primarily driven by market oversupply and reduced demand from the lubricant sector, which weakened price stability. Seasonal monsoon patterns, coupled with ongoing logistics challenges, further disrupted imports, prompting a shift toward greater reliance on locally sourced base oil. Additionally, a cautious purchasing environment and subdued market sentiment intensified the price drop, as buyers remained hesitant to secure large volumes amid uncertain demand forecasts. Analysts closely monitored these fluctuations using the Base Oil Price Chart, which provided critical insights into price movements and regional supply dynamics. The complex interplay of oversupply, seasonal disruptions, and shifting demand patterns shaped Singapore's base oil market during the quarter, highlighting the importance of adaptive strategies to navigate evolving industry conditions.

Regional Analysis: The price analysis can be extended to provide detailed base oil price information for the following list of countries.

China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries.

Europe Base Oil Prices Movement Last Quarter:

Base Oil Prices in the Netherlands:

|

Product |

Category |

Price |

|

Base Oil |

Chemical |

1,045 USD/MT |

In Q3 2024, Base Oil Prices Historical Data highlighted stability in base oil prices in the Netherlands, which reached 1,045 USD/MT in September. This stability was underpinned by improved supply conditions and a decline in crude oil costs, which helped balance the market. Although seasonal market activity slowed during the summer, earlier shipping disruptions were resolved by September, further supporting price equilibrium. The market demonstrated resilience, maintaining stability despite external challenges, showcasing the effectiveness of balanced supply and cost management in sustaining steady price trends.

Regional Analysis: The price analysis can be expanded to include detailed base oil price data for a wide range of European countries:

such as Germany, France, the United Kingdom, Italy, Spain, Russia, Turkey, the Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, the Czech Republic, Portugal, and Greece, along with other European nations.

MEA Base Oil Prices Movement Last Quarter:

Base Oil Prices in Saudi Arabia:

|

Product |

Category |

Price |

|

Base Oil |

Chemical |

1,760 USD/MT |

In Q3 2024, Base Oil Prices News highlighted the stability of base oil prices in Saudi Arabia, which settled at 1,760 USD/MT in September. The market exhibited a balanced pricing environment, driven by supply challenges and robust demand that supported bullish pricing in July. However, the typical summer slowdowns in August moderated this upward trend, contributing to overall price stability. Saudi Arabia’s consistent demand, coupled with limited supply, reinforced a steady pricing framework, reflecting the region’s resilience amidst seasonal and market-specific dynamics.

Regional Analysis: The price analysis can be extended to provide detailed base oil price information for the following list of countries.

Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries.

Factors Affecting Base Oil Demand and Prices?

The demand and prices of base oil are influenced by several key factors, including fluctuations in crude oil prices, as base oil is derived from refining crude petroleum. Industrial demand from sectors such as automotive, manufacturing, and lubricants plays a crucial role in shaping the base oil price trend. Additionally, supply chain disruptions, geopolitical tensions, and environmental regulations impact production costs and availability. Seasonal variations, technological advancements in lubricant formulations, and the growing shift toward synthetic alternatives further affect base oil demand and prices, leading to market volatility.

Speak To An Analyst: https://www.imarcgroup.com/request?type=report&id=22299&flag=C

Key Coverage:

- Market Analysis

- Market Breakup by Region

- Demand Supply Analysis by Type

- Demand Supply Analysis by Application

- Demand Supply Analysis of Raw Materials

- Price Analysis

- Spot Prices by Major Ports

- Price Breakup

- Price Trends by Region

- Factors Influencing the Price Trends

- Market Drivers, Restraints, and Opportunities

- Competitive Landscape

- Recent Developments

- Global Event Analysis

How the IMARC Pricing Database Can Help

The latest IMARC Group study, “Base Oil Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2024 Edition,” presents a detailed analysis of Base Oil price trend, offering key insights into global Base Oil market dynamics. This report includes comprehensive price charts, which trace historical data and highlight major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines Base Oil demand, illustrating how consumer behavior and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the price report uncovers critical factors influencing current and future prices.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals, licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis and regional insights covering Asia-Pacific, Europe, North America, Latin America, the Middle East, and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and researching market drivers, restraints, and opportunities. IMARC’s data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

Comments

0 comment