views

Global AI in Fintech Industry: Key Statistics and Insights in 2025-2033

Summary:

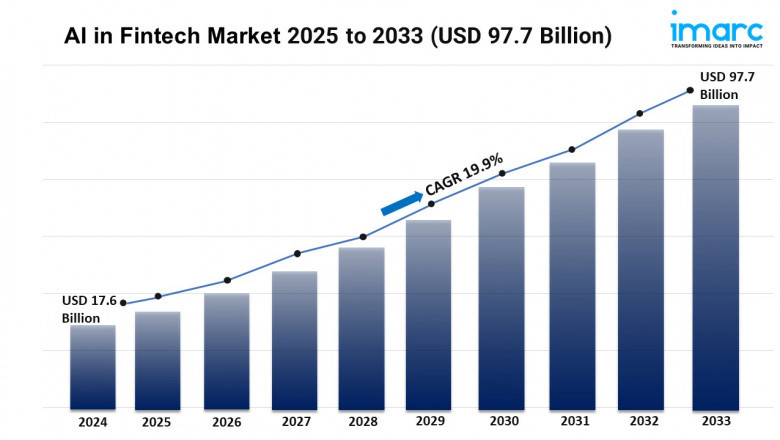

- The global AI in fintech market size reached USD 17.6 Billion in 2024.

- The market is expected to reach USD 97.7 Billion by 2033, exhibiting a growth rate (CAGR) of 19.9% during 2025-2033.

- North America leads the market, accounting for the largest AI in fintech market share.

- Solutions hold the largest share in the AI in fintech industry.

- Cloud-based represents the leading deployment mode segment.

- Based on the application, the market has been divided into virtual assistant (chatbots), credit scoring, quantitative and asset management, fraud detection, and others.

- Enhanced fraud detection and risk management is a primary driver of the AI in fintech market.

- The increasing demand for personalized financial services and rising focus on operational efficiency and cost reduction are reshaping the AI in fintech market.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/ai-in-fintech-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends And Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- AI-Driven Fraud Detection:

The rise of AI in fraud detection is transforming fintech by enabling real-time, predictive analytics. Traditional rule-based systems are being replaced by machine learning models that analyze vast datasets to identify suspicious patterns. Banks and payment processors now leverage AI to reduce false positives, cut losses, and enhance customer trust. As cyber threats grow more sophisticated, demand for adaptive AI solutions is surging, with global spending expected to exceed $10 billion by 2026. This dynamic is reshaping risk management, making transactions safer while streamlining compliance.

- Personalized Financial Services:

AI is revolutionizing customer experiences through hyper-personalized financial services. By analyzing spending habits, credit history, and even social media activity, AI tailors recommendations for loans, investments, and savings. Robo-advisors, chatbots, and AI-powered budgeting tools are becoming mainstream, driving user engagement and loyalty. Fintech firms that integrate these technologies gain a competitive edge, as 68% of consumers now expect personalized financial advice. The demand for AI-driven customization is accelerating, pushing firms to adopt smarter, data-centric approaches.

- Regulatory AI Compliance:

As financial regulations tighten, AI is emerging as a critical tool for automating compliance. Fintechs and traditional banks are deploying AI to monitor transactions, flag anomalies, and generate audit-ready reports in seconds. Natural language processing (NLP) helps parse complex legal documents, ensuring adherence to evolving laws like GDPR and anti-money laundering (AML) rules. This reduces manual workloads and minimizes human error, saving firms millions in penalties. With regulators increasingly favoring AI-aided oversight, adoption is set to grow rapidly, making compliance faster and more cost-effective.

Leading Companies Operating in the Global AI in Fintech Industry:

- Amazon Web Services Inc. (Amazon.com Inc)

- Google LLC (Alphabet Inc.)

- Inbenta Technologies Inc.

- Intel Corporation

- International Business Machines Corporation

- Microsoft Corporation

- Salesforce.com Inc.

- Samsung Electronics Co. Ltd.

- TIBCO Software Inc.

- Trifacta

- Verint Systems Inc.

AI in Fintech Market Report Segmentation:

Breakup By Type:

- Solutions

- Services

Solutions exhibit a clear dominance in the market attributed to the increasing adoption of AI-driven software and platforms that enhance the efficiency and effectiveness of financial services.

Breakup By Deployment Mode:

- Cloud-based

- On-premises

Cloud-based represents the largest segment owing to its scalability, flexibility, and lower costs.

Breakup By Application:

- Virtual Assistant (Chatbots)

- Credit Scoring

- Quantitative and Asset Management

- Fraud Detection

- Others

Based on the application, the market has been divided into virtual assistant (chatbots), credit scoring, quantitative and asset management, fraud detection, and others.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America dominates the market due to its advanced technological infrastructure, rising investments in AI innovation, and the presence of major fintech companies.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Comments

0 comment