views

"Treasury Software Market Size And Forecast by 2030

Central to the analysis is the identification and evaluation of the Top 10 Companies in the Treasury Software Market. These organizations are recognized for their substantial market share and pivotal roles in driving industry growth. The report provides a detailed assessment of their business strategies, ranging from product development to market expansion efforts. It also highlights how these companies leverage technological advancements and market trends to maintain their leadership positions.

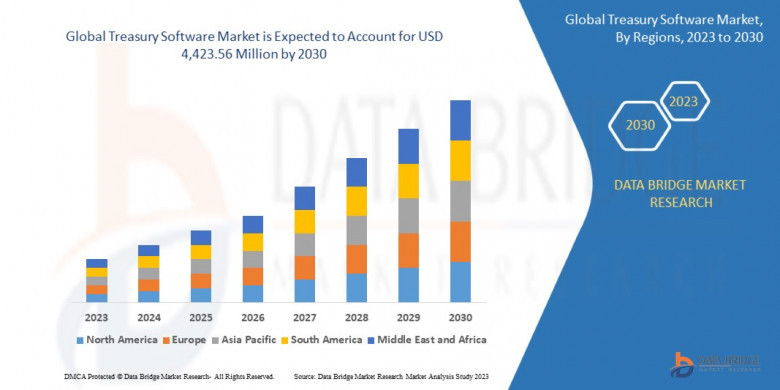

The global treasury software market is expected to gain market growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 3.1% from 2023 to 2030 and is expected to reach USD 4,423.56 million by 2030.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-treasury-software-market

Which are the top companies operating in the Treasury Software Market?

The Top 10 Companies in Treasury Software Market include well-established players. These companies are known for their market expertise, strong product portfolios, and significant market share. Their innovation, customer focus, and global operations have helped them maintain leadership positions in the market, offering high-quality solutions and services that meet the evolving needs of consumers.

**Segments**

- Based on type, the global treasury software market can be segmented into cloud-based and on-premises solutions. Cloud-based solutions are gaining popularity due to their scalability and cost-effectiveness, allowing organizations to access their treasury software from anywhere with an internet connection. On-premises solutions, on the other hand, provide greater control over data security and customization options.

- In terms of deployment, the market can be segmented into large enterprises and small & medium-sized enterprises (SMEs). Large enterprises often have more complex treasury management needs and require robust software solutions to handle a high volume of transactions. SMEs, on the other hand, may opt for simpler treasury software that caters to their specific requirements and budget constraints.

- Geographically, the global treasury software market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America currently holds a significant market share due to the presence of key players and early adoption of advanced technologies. However, the Asia Pacific region is expected to witness rapid growth in the coming years, driven by increasing digitalization initiatives and the expansion of the financial services sector in countries like China and India.

**Market Players**

- Some of the key players in the global treasury software market include SAP SE, Oracle Corporation, FIS, Kyriba Corp, GTreasury, Calypso Technology Inc., ION Group, Broadridge Financial Solutions, Inc., Reval, and TreasuryXpress. These market players are constantly innovating their software offerings to cater to the evolving needs of organizations in managing their treasury functions efficiently. Strategic partnerships, acquisitions, and product enhancements are common strategies employed by these players to maintain their competitive edge in the market.

For more detailed insights and comprehensive analysis of the global treasury software market, refer to: https://www.databridgemarketresearch.com/reports/global-treasury-software-marketThe global treasury software market is expected to witness continued growth and evolution in the coming years, driven by several key factors shaping the industry landscape. One trend that is likely to influence the market significantly is the increasing adoption of artificial intelligence (AI) and machine learning technologies in treasury management solutions. AI-powered tools can help organizations automate routine tasks, optimize cash management, improve risk management processes, and enhance decision-making capabilities. As AI continues to advance, we can expect to see a greater integration of these technologies into treasury software solutions, providing users with more sophisticated tools to streamline their financial operations.

Another important aspect that is shaping the treasury software market is the emphasis on data security and compliance. With the increasing volume of financial transactions and the growing complexity of regulatory requirements, organizations are prioritizing robust security measures within their treasury software systems. Market players are investing heavily in developing encryption methods, authentication protocols, and other security features to safeguard sensitive financial data and ensure compliance with global regulations such as GDPR and CCPA. Additionally, the integration of blockchain technology in treasury software solutions is also gaining traction for its potential to enhance data security, transparency, and efficiency in financial transactions.

Furthermore, the rising trend of treasury automation is expected to have a significant impact on the market dynamics. As organizations strive to streamline their treasury operations and reduce manual workloads, there is a growing demand for automated software solutions that can perform tasks such as cash forecasting, liquidity management, and risk analysis. Treasury automation not only improves operational efficiency but also enables treasury teams to focus on strategic decision-making and value-added activities. Market players are responding to this trend by developing advanced automation features and integrations within their software offerings to meet the evolving needs of treasury departments across various industries.

Moreover, the increasing focus on real-time data analytics and reporting capabilities is driving innovation in the treasury software market. Organizations are seeking software solutions that can provide them with actionable insights and visualization tools to monitor key performance indicators, track financial trends, and make informed decisions in real-time. By leveraging advanced analytics technologies, treasury software vendors are enabling users to gain deeper insights into their financial data, identify potential risks and opportunities, and optimize cash flows more effectively.

In conclusion, the global treasury software market is evolving rapidly to meet the changing needs of modern organizations in managing their treasury functions efficiently. With the continued advancements in AI, data security, treasury automation, and analytics capabilities, market players are poised to deliver innovative solutions that drive operational excellence, enhance decision-making processes, and enable strategic growth for businesses worldwide.**Segments**

Global Treasury Software Market, By Operating System: The global treasury software market is segmented based on the operating system into Windows, Linux, iOS, Android, and MAC. Each operating system offers unique features and compatibility options that cater to the diverse needs of organizations in managing their treasury functions efficiently.

Application: The market is further segmented by application into Liquidity and Cash Management, Investment Management, Debt Management, Financial Risk Management, Compliance Management, Tax Planning, and Others. These applications address specific aspects of treasury management, allowing organizations to tailor their software solutions to meet their precise requirements.

Deployment Mode: The deployment modes in the global treasury software market include On-Premise and Cloud-based solutions. Organizations can choose the deployment mode that best aligns with their IT infrastructure, security preferences, and scalability needs.

Organization Size: The market is segmented by organization size into Large Enterprises and Small and Medium-Sized Enterprises. Different software solutions cater to the distinct requirements of large corporations with complex treasury operations and smaller businesses seeking more streamlined treasury management options.

Vertical: The market is segmented by vertical into Banking, Financial Services and Insurance, Government, Manufacturing, Healthcare, Consumer Goods, Chemicals, Energy, and Others. Each vertical has unique treasury management needs, requiring specialized software solutions to optimize financial operations effectively.

**Market Players**

- Finastra

- ZenTreasury Ltd

- Emphasys Software

- SS&C Technologies, Inc.

- CAPIX

- Adenza

- Coupa Software Inc.

- DataLog Finance

- FIS

- Access Systems (UK) Limited

- Treasury Software Corp.

- MUREX S.A.S

- EdgeVerve Systems Limited (A wholly-owned subsidiary of Infosys)

- Financial Sciences Corp.

- Broadridge Financial Solutions, Inc.

- CashAnalytics

- Oracle

- Fiserv, Inc

- ION

- SAP

- Solomon Software

- ABM CLOUD

- Among Others

The global treasury software market continues to evolve, driven by various factors influencing industry dynamics. The increasing adoption of AI and machine learning technologies is reshaping treasury management solutions, enabling automation of tasks, enhancing decision-making processes, and optimizing cash management. Data security and compliance remain key priorities, leading to investments in robust security measures and blockchain technology integration to safeguard financial data and ensure regulatory adherence. Treasury automation is on the rise, offering efficiency gains and enabling strategic focus for treasury teams. Real-time data analytics capabilities are becoming essential, providing actionable insights for informed decision-making and improved financial performance monitoring. With ongoing advancements in AI, data security, automation, and analytics, market players are well-positioned to deliver innovative solutions that drive operational excellence and strategic growth for organizations globally.

Explore Further Details about This Research Treasury Software Market Report https://www.databridgemarketresearch.com/reports/global-treasury-software-market

Key Insights from the Global Treasury Software Market :

- Comprehensive Market Overview: The Treasury Software Market is experiencing robust growth, fueled by increasing adoption of innovative technologies and evolving consumer demands.

- Industry Trends and Projections: The market is expected to grow at a CAGR of X% over the next five years, with digital transformation and sustainability driving key trends.

- Emerging Opportunities: Rising consumer demand for eco-friendly and customizable products is creating significant market opportunities.

- Focus on R&D: Companies are intensifying their focus on R&D to develop advanced solutions and stay ahead of emerging market trends.

- Leading Player Profiles: Key players are at the forefront, with strong market shares and continuous innovation.

- Market Composition: The market consists of a mix of large established players and smaller, agile companies, each contributing to dynamic competition.

- Revenue Growth: The market is experiencing steady revenue growth, driven by increased consumer spending and expanding product offerings.

- Commercial Opportunities: There are ample commercial opportunities in untapped regions, particularly in emerging economies with growing demand.

DBMR Cloud-connected intelligence: Bridging the gap with revenue-impacting solutions

DBMR Cloud is a connected intelligence platform that uses a neural network to analyze and integrate macro and micro-level data, bridging the gap between data analytics, market research, and strategy for profound growth and revenue impact.

Get More Detail: https://www.databridgemarketresearch.com/nucleus/global-treasury-software-market

Find Country based languages on reports:

https://www.databridgemarketresearch.com/jp/reports/global-treasury-software-market

https://www.databridgemarketresearch.com/zh/reports/global-treasury-software-market

https://www.databridgemarketresearch.com/ar/reports/global-treasury-software-market

https://www.databridgemarketresearch.com/pt/reports/global-treasury-software-market

https://www.databridgemarketresearch.com/de/reports/global-treasury-software-market

https://www.databridgemarketresearch.com/fr/reports/global-treasury-software-market

https://www.databridgemarketresearch.com/es/reports/global-treasury-software-market

https://www.databridgemarketresearch.com/ko/reports/global-treasury-software-market

https://www.databridgemarketresearch.com/ru/reports/global-treasury-software-market

Data Bridge Market Research:

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 975

Comments

0 comment