views

Comprehensive historical analysis of Global Insurance Fraud Detection Market for has thoroughly analyzed in this report. It offers data and insights from 2019-2022, and provides extensive market forecasts from 2023-2032 by region/country and subsectors. It covers the price, sales volume, revenue, historical growth, gross margin, and future outlooks for the Insurance Fraud Detection market.

The report includes growth prospects in the global Insurance Fraud Detection market by type, application, sub segement and region and QMI has compiled a comprehensive detailed research report to offer insights. The report details consumption in the Banking & Financial and other sectors. Regional coverage spans North America, Europe, and rest of the world including Asia Pacific.

Request To Download Free Sample copy of the report @ https://www.sphericalinsights.com/request-sample/8230

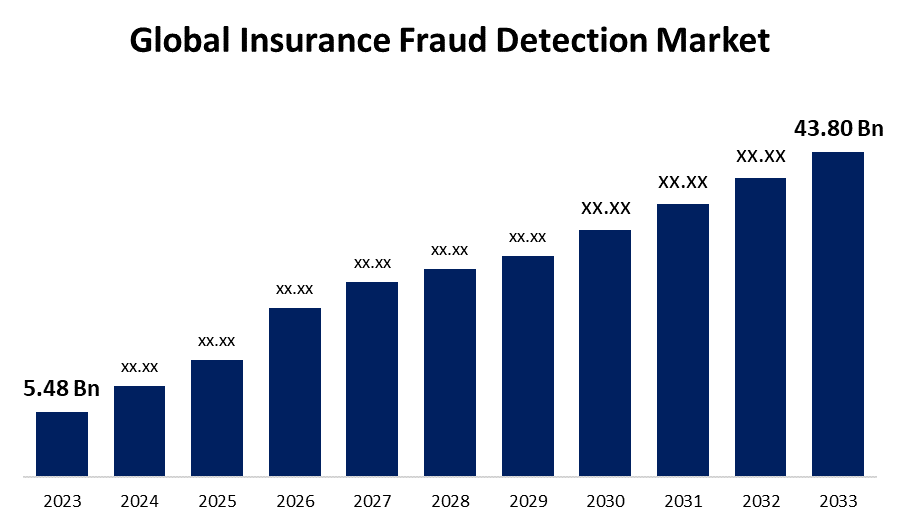

The Global Insurance Fraud Detection Market size was valued at USD 5.48 billion in 2023 and is slated to reach USD 43.80 billion by 2033, growing at a CAGR of 23.10% from 2023 to 2033.

The insurance industry is a cornerstone of financial security, providing individuals and businesses with the protection they need against unforeseen risks. However, with the rise in fraudulent activities, the industry faces significant challenges in maintaining trust and profitability. According to a recent report by Spherical Insights, the Insurance Fraud Detection Market is rapidly evolving to combat these threats, leveraging advanced technologies to safeguard the integrity of the sector.

In this blog, we’ll explore the key trends, technologies, and drivers shaping the insurance fraud detection market, and why it’s more critical than ever for insurers to invest in robust fraud detection systems.

The Rising Threat of Insurance Fraud

Insurance fraud is a multi-billion-dollar problem worldwide. From exaggerated claims to staged accidents and identity theft, fraudulent activities are becoming increasingly sophisticated. The Coalition Against Insurance Fraud estimates that fraud costs the industry over $80 billion annually in the U.S. alone. This not only impacts insurers’ bottom lines but also leads to higher premiums for honest policyholders.

As fraudsters employ more advanced tactics, traditional methods of fraud detection are no longer sufficient. This is where the insurance fraud detection market steps in, offering innovative solutions to identify and prevent fraudulent activities in real-time.

Key Drivers of the Insurance Fraud Detection Market

The Spherical Insights report highlights several factors driving the growth of the insurance fraud detection market:

-

Technological Advancements: The integration of artificial intelligence (AI), machine learning (ML), and big data analytics has revolutionized fraud detection. These technologies enable insurers to analyze vast amounts of data, identify patterns, and detect anomalies that may indicate fraudulent behavior.

-

Increasing Fraud Cases: As the frequency and complexity of fraud cases rise, insurers are under pressure to adopt advanced detection systems to mitigate risks and reduce losses.

-

Regulatory Compliance: Governments and regulatory bodies are implementing stricter regulations to combat insurance fraud. Insurers are required to invest in compliance measures, including fraud detection tools, to avoid penalties and maintain their reputations.

-

Cost Efficiency: Implementing fraud detection systems not only reduces losses but also improves operational efficiency by automating manual processes and minimizing false positives.

Check discount for this report: https://www.sphericalinsights.com/request-discount/8230

Emerging Technologies in Fraud Detection

The insurance fraud detection market is witnessing a surge in innovative technologies designed to outsmart fraudsters. Some of the most impactful include:

-

AI and Machine Learning: These technologies enable predictive analytics, allowing insurers to identify potential fraud before it occurs. By analyzing historical data, AI systems can flag suspicious claims and behaviors.

-

Blockchain: Blockchain technology offers a secure and transparent way to store and share data, making it harder for fraudsters to manipulate information.

-

Natural Language Processing (NLP): NLP helps analyze unstructured data, such as claim descriptions and customer communications, to detect inconsistencies and red flags.

-

IoT and Telematics: In sectors like auto insurance, IoT devices and telematics provide real-time data on vehicle usage, helping insurers verify claims and detect fraudulent activities.

Challenges in the Insurance Fraud Detection Market

While the market is growing, it’s not without its challenges. Insurers face hurdles such as:

-

High Implementation Costs: Advanced fraud detection systems require significant investment in technology and skilled personnel.

-

Data Privacy Concerns: The use of sensitive customer data raises privacy issues, necessitating robust data protection measures.

-

False Positives: Overly sensitive systems may flag legitimate claims as fraudulent, leading to customer dissatisfaction.

The Future of Insurance Fraud Detection

The Spherical Insights report predicts a bright future for the insurance fraud detection market, with continued growth driven by technological innovation and increasing awareness of fraud risks. As insurers embrace AI, blockchain, and other cutting-edge tools, they will be better equipped to protect their businesses and customers from fraudulent activities.

Moreover, collaboration between insurers, technology providers, and regulatory bodies will play a crucial role in creating a more secure and transparent insurance ecosystem.

Conclusion

The insurance fraud detection market is no longer a niche segment but a critical component of the insurance industry’s future. By leveraging advanced technologies and adopting proactive strategies, insurers can stay ahead of fraudsters and ensure the sustainability of their operations.

For a deeper dive into the trends and insights shaping this market, check out the full report by Spherical Insights here.

As the battle against insurance fraud intensifies, one thing is clear: investing in fraud detection is not just a business necessity—it’s a commitment to protecting the trust and confidence of policyholders worldwide.

What are your thoughts on the future of insurance fraud detection? Share your insights in the comments below!

Related Reports:

About the Spherical Insights

Spherical Insights is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

Contact Us:

Company Name: Spherical Insights

Email: sales@sphericalinsights.com

Phone: +1 303 800 4326 (US)

Comments

0 comment