views

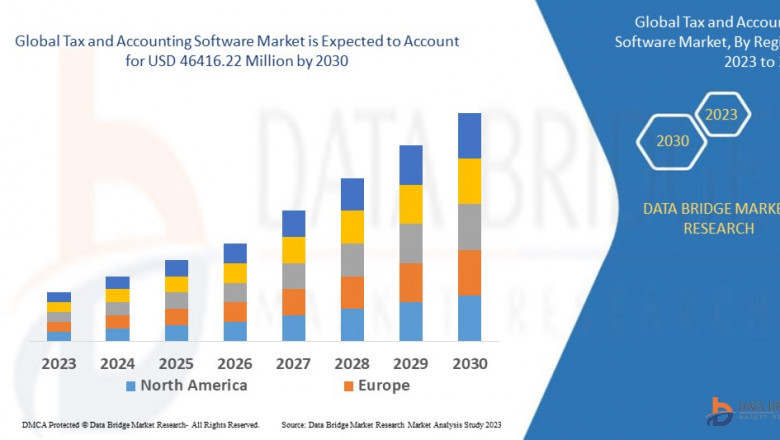

"Global Tax and Accounting Software Market - Size, Share, Industry Trends, Demand and Opportunities

Access Full 350-page PDF Report @

https://www.databridgemarketresearch.com/reports/global-tax-and-accounting-software-market

**Segments**

- On-premise tax and accounting software

- Cloud-based tax and accounting software

The global tax and accounting software market can be segmented into two main categories: on-premise and cloud-based solutions. On-premise software requires installation and maintenance on the user's own servers, offering more control over data but requiring higher initial costs and long-term maintenance. On the other hand, cloud-based solutions are hosted on remote servers, offering accessibility from anywhere with an internet connection, scalability, and automatic updates. As more businesses transition to cloud-based services for increased flexibility and cost-effectiveness, the cloud-based segment is expected to dominate the market in the coming years.

**Market Players**

- Intuit Inc.

- Thomson Reuters

- Sage Group

- Wolters Kluwer

- H&R Block

- Xero Limited

- Intacct Corporation

- Drake Software

- IBM Corporation

The global tax and accounting software market is highly competitive, with key players such as Intuit Inc., Thomson Reuters, Sage Group, Wolters Kluwer, and H&R Block dominating the industry. These companies offer a wide range of solutions catering to different business sizes and industries, providing features for tax calculations, financial reporting, payroll management, compliance, and more. Additionally, emerging players like Xero Limited, Intacct Corporation, Drake Software, and IBM Corporation are also gaining traction in the market by offering innovative technologies and customized solutions to meet evolving business needs.

https://www.databridgemarketresearch.com/reports/global-tax-and-accounting-software-marketThe global tax and accounting software market is witnessing significant growth driven by technological advancements, increasing adoption of cloud-based solutions, and the growing use of automation in financial processes. One key trend reshaping the market is the shift towards integrated platforms that offer end-to-end solutions for tax compliance, accounting, and financial management. This allows businesses to streamline their operations, increase efficiency, and ensure regulatory compliance in a seamless manner. Integrated platforms also enable real-time data sharing and collaboration among different departments within an organization, leading to improved decision-making and overall performance.

Another notable trend in the market is the rising demand for mobile and remote access capabilities in tax and accounting software. With the workforce becoming increasingly mobile and the rise of remote work arrangements, businesses are seeking solutions that enable users to access and update financial data on the go. Mobile-friendly applications and cloud-based platforms are providing flexibility and convenience to users, allowing them to stay connected and productive from anywhere, at any time. This trend is expected to continue driving the adoption of cloud-based solutions and fueling market growth in the foreseeable future.

Moreover, the focus on data security and compliance is playing a crucial role in shaping the tax and accounting software market landscape. With the increasing volume of sensitive financial data being handled by businesses, ensuring data security and regulatory compliance have become paramount. Market players are investing in robust security measures, encryption technologies, and compliance frameworks to protect user data and maintain trust among customers. Additionally, advancements in artificial intelligence and machine learning are being leveraged to enhance fraud detection, risk management, and compliance monitoring capabilities in tax and accounting software systems.

Furthermore, the market is witnessing a growing demand for industry-specific solutions tailored to meet the unique requirements of different sectors such as healthcare, retail, manufacturing, and professional services. Industry-specific tax and accounting software offer specialized features and functionalities designed to address sector-specific challenges, compliance regulations, and reporting requirements. This trend is driven by the need for more customized solutions that can cater to the specific needs of different industries, leading to increased adoption and market expansion.

In conclusion, the global tax and accounting software market is poised for continued growth and innovation fueled by trends such as integrated platforms, mobile access capabilities, data security, compliance focus, and industry-specific solutions. Market players need to stay abreast of these trends and invest in research and development to deliver cutting-edge solutions that meet the evolving needs of businesses in an increasingly complex and digital world.The global tax and accounting software market is undergoing a significant transformation driven by technological advancements, changing business needs, and regulatory requirements. Market players are witnessing a shift towards integrated platforms that offer comprehensive solutions for tax compliance, accounting, and financial management. This trend is reshaping the market landscape by enabling businesses to streamline their operations, improve efficiency, and ensure regulatory adherence seamlessly. Integrated platforms facilitate real-time data sharing and collaboration, leading to enhanced decision-making processes and overall organizational performance. As businesses increasingly seek cohesive solutions to manage their financial processes, the demand for integrated platforms is expected to continue rising in the market.

Additionally, there is a growing emphasis on mobile and remote access capabilities in tax and accounting software solutions. With the rise of remote work trends and a mobile workforce, businesses are prioritizing software that enables users to access and update financial data on the go. The integration of mobile-friendly applications and cloud-based platforms provides users with flexibility and convenience, allowing them to stay connected and productive regardless of their location. The increasing demand for mobile and remote access capabilities is anticipated to drive the adoption of cloud-based solutions and contribute to market growth in the coming years.

Moreover, data security and compliance have become key focal points for market players in the tax and accounting software industry. Given the escalating volume of sensitive financial data being managed by organizations, ensuring data security and compliance with regulatory standards is imperative. Market participants are investing in robust security measures, encryption technologies, and compliance frameworks to safeguard user data and uphold customer trust. Furthermore, the integration of artificial intelligence and machine learning technologies is enhancing fraud detection, risk management, and compliance monitoring capabilities within tax and accounting software systems. These advancements are crucial in mitigating risks, improving data protection, and meeting regulatory obligations in an increasingly digital and data-driven environment.

Furthermore, there is a rising demand for industry-specific tax and accounting software tailored to meet the unique requirements of various sectors such as healthcare, retail, manufacturing, and professional services. Industry-specific solutions offer specialized features and functionalities designed to address sector-specific challenges, compliance regulations, and reporting standards. This trend is being driven by the need for customized solutions that cater to the specific needs of diverse industries, leading to increased adoption and market expansion. As businesses seek software solutions that align with their industry requirements, the demand for industry-specific tax and accounting software is expected to grow, presenting opportunities for market players to diversify their offerings and cater to a broader clientele base.

In conclusion, the global tax and accounting software market is characterized by ongoing innovation, driven by trends such as integrated platforms, mobile access capabilities, data security, compliance focus, and industry-specific solutions. Market participants are encouraged to stay abreast of these trends, invest in research and development initiatives, and develop cutting-edge solutions that align with the evolving needs of businesses operating in an increasingly digital and complex environment. The market outlook remains positive, with ample opportunities for growth and differentiation by addressing key market trends and providing tailored solutions to meet the diverse needs of businesses across various industries.**Segments**

Global Tax and Accounting Software Market, By Product (Web-based, Installed, I-Phone Operating System (iOS), Android), Deployment Model (0n-Premises, Cloud), Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), Application (Personal Use, General Company, Listed Company, Government, Others), End User (Healthcare, Manufacturing, Retail and Consumer Goods, IT and Telecommunications, BFSI, Others) – Industry Trends and Forecast to 2030.

The global tax and accounting software market is a dynamic landscape with various segments catering to different user preferences and business needs. The segmentation based on product includes web-based, installed, iOS, and Android platforms, offering a variety of options for users to choose from based on their technological preferences. The deployment model segmentation between on-premises and cloud-based solutions provides businesses with flexibility in choosing the right infrastructure that aligns with their IT strategies and operational requirements. Furthermore, the segmentation based on organization size categorizes solutions into those tailored for small and medium-sized enterprises versus large enterprises, ensuring that the software meets the scalability and functionality needs of businesses of varying sizes. The application segmentation highlights the diverse use cases for tax and accounting software across personal use, general company operations, listed companies, government entities, and other specialized applications. Additionally, the end-user segmentation identifies key industries such as healthcare, manufacturing, retail and consumer goods, IT and telecommunications, BFSI, and others, showcasing the wide-reaching impact of tax and accounting software across different sectors.

The global tax and accounting software market continues to evolve, driven by technological advancements, changing user preferences, and regulatory requirements. The industry is witnessing a shift towards integrated platforms that offer comprehensive solutions for tax compliance, accounting, and financial management, leading to streamlined operations and enhanced efficiency for businesses. This trend is reshaping the market landscape by enabling seamless data sharing and collaboration among different departments, thereby improving decision-making processes and overall organizational performance. As businesses seek holistic solutions to manage their financial processes in an integrated manner, the demand for such platforms is expected to rise significantly.

Furthermore, the market is experiencing a surge in the adoption of mobile and remote access capabilities in tax and accounting software solutions. With the increasing prevalence of remote work setups and the need for on-the-go access to financial data, businesses are increasingly prioritizing software that offers mobility and flexibility. The integration of mobile-friendly applications and cloud-based platforms provides users with the ability to stay connected and productive from anywhere. This trend is not only driving the adoption of cloud-based solutions but is also expected to contribute to market growth in the foreseeable future as businesses continue to embrace remote work arrangements and mobile technologies in their day-to-day operations.

Data security and compliance are also emerging as critical priorities for market players in the tax and accounting software industry. Given the growing volumes of sensitive financial data being handled by organizations, ensuring data security and compliance with regulatory standards have become paramount. Market participants are investing in robust security measures, encryption technologies, and compliance frameworks to safeguard user data and uphold customer trust. Moreover, the integration of artificial intelligence and machine learning technologies is enhancing fraud detection, risk management, and compliance monitoring capabilities within tax and accounting software systems, further fortifying data protection and regulatory adherence in a digital, data-driven environment.

Additionally, there is a rising demand for industry-specific tax and accounting software tailored to address the unique needs of different sectors such as healthcare, retail, manufacturing, and professional services. These specialized solutions offer sector-specific features and functionalities designed to tackle industry-specific challenges, compliance regulations, and reporting standards. The increasing adoption of industry-specific software is being fueled by businesses' need for customized solutions that cater to their distinct requirements. This trend is expected to continue driving market growth, providing opportunities for market players to diversify their product offerings and cater to a broader range of industries effectively.

In conclusion, the global tax and accounting software market presents a landscape of ongoing innovation and evolution, characterized by trends such as integrated platforms, mobile access capabilities, data security, compliance focus, and industry-specific solutions. Market participants are encouraged to stay attuned to these trends, invest in research and development efforts, and deliver cutting-edge solutions that meet the evolving needs of businesses in an ever-changing digital environment. With ample opportunities for growth and differentiation by addressing key market trends and providing tailored solutions to diverse industries, the market outlook remains optimistic for players in the tax and accounting software space.

Core Objective of Tax and Accounting Software Market:

Every firm in the Tax and Accounting Software Market has objectives but this market research report focus on the crucial objectives, so you can analysis about competition, future market, new products, and informative data that can raise your sales volume exponentially.

- Size of the Tax and Accounting Software Market and growth rate factors.

- Important changes in the future Tax and Accounting Software Market.

- Top worldwide competitors of the Market.

- Scope and product outlook of Tax and Accounting Software Market.

- Developing regions with potential growth in the future.

- Tough Challenges and risk faced in Market.

- Global Tax and Accounting Software top manufacturers profile and sales statistics.

Key takeaways from the Tax and Accounting Software Market report:

- Detailed considerate of Tax and Accounting Software Market-particular drivers, Trends, constraints, Restraints, Opportunities and major micro markets.

- Comprehensive valuation of all prospects and threat in the

- In depth study of industry strategies for growth of the Tax and Accounting Software Market-leading players.

- Tax and Accounting Software Market latest innovations and major procedures.

- Favorable dip inside Vigorous high-tech and market latest trends remarkable the Market.

- Conclusive study about the growth conspiracy of Tax and Accounting Software Market for forthcoming years.

Frequently Asked Questions

- What is the Future Market Value for Tax and Accounting Software Market?

- What is the Growth Rate of the Tax and Accounting Software Market?

- What are the Major Companies Operating in the Tax and Accounting Software Market?

- Which Countries Data is covered in the Tax and Accounting Software Market?

- What are the Main Data Pointers Covered in Tax and Accounting Software Market Report?

Browse Trending Reports:

3D Printed Wearable Market Size, Share and Trends

Supply Chain Analytics Market Size, Share and Trends

Spinal Imaging Market Size, Share and Trends

Power-Packed Liquid Vitamin Market Size, Share and Trends

Prosthetic Valve Endocarditis Market Size, Share and Trends

Mobile Stroke Unit (MSU) Market Size, Share and Trends

Lined Valve Market Size, Share and Trends

Motor Yatch Market Size, Share and Trends

MEMs Speaker Market Size, Share and Trends

Packaging Foams Market Size, Share and Trends

Climate Control System for Commercial Vehicle Market Size, Share and Trends

Digital Health Monitoring Devices Market Size, Share and Trends

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Comments

0 comment