views

South Korea Private Equity Market Overview

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

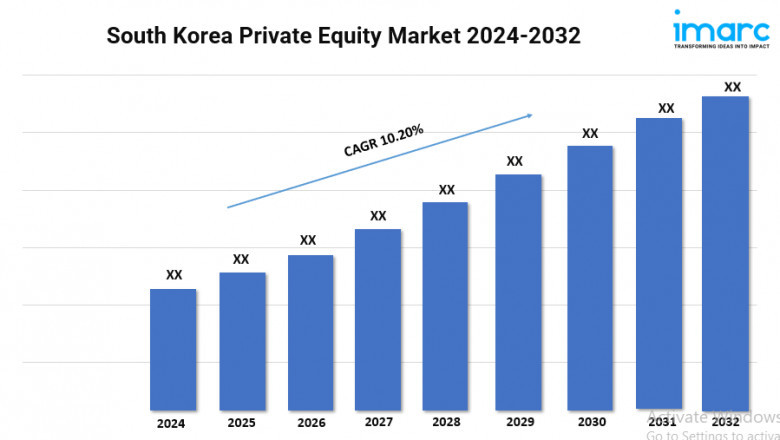

Market Growth Rate: 10.20% (2024-2032)

South Korea offers a thriving landscape for private investments, driven by robust economic growth, innovation, and a dynamic business environment. According to the latest report by IMARC Group, South Korea private equity market size is projected to exhibit a growth rate (CAGR) of 10.20% during 2024-2032.

Download sample copy of the Report: https://www.imarcgroup.com/south-korea-private-equity-market/requestsample

South Korea Private Equity Industry Trends and Drivers:

South Korea private equity market has shown fast development because of good economic conditions combined with rising investor demand for high-return investments. South Korean private equity firms are benefiting from the country’s industrial diversification and innovation through sectors like technology healthcare and renewable energy. The government’s supportive policies for venture capital and private equity, along with regulatory incentives, help build a positive investment climate. Institutional investors such as pension funds and sovereign wealth funds showing increased participation demonstrate rising confidence in South Korea private equity market. In the South Korean private equity market buyouts combined with growth capital investments represent a major market trend. Middle-market companies and startups with high growth potential receive funding and strategic guidance from private equity firms to speed their expansion. The strategy enables businesses to both expand their operations and enhance their performance while fostering more innovation.

South Korea firms expanding globally and international investors seeking exposure to South Korea’s dynamic industries are both driving increases in cross-border deals. This trend is increasing collaboration and is strengthening South Korea’s role as a key player in global investments. Additionally, environmental, social, and governance or ESG concerns are now a core part of private equity investment plans. As global investors focus on sustainability and ethical business practices, South Korean firms position themselves accordingly to increase their market appeal. With continued economic growth, strong investor confidence, and a focus on strategic investments, South Korea private equity market is expected to sustain its momentum in the coming years. The future of private equity in South Korea will depend on domestic expansion global integration and sustainable investment practices.

We explore the factors propelling the South Korea private equity market growth, including technological advancements, consumer behaviors, and regulatory changes.

South Korea Private Equity Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Fund Type:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current, and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Comments

0 comment