views

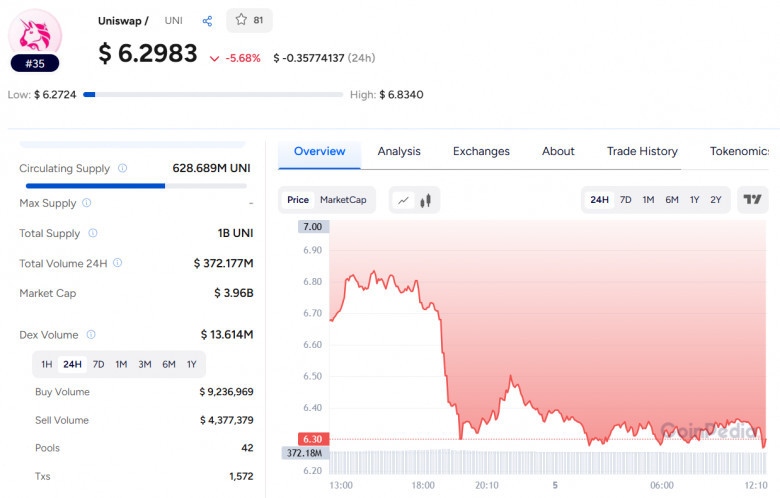

Uniswap (UNI) is trading at $6.3020, down 0.53% in the last hour and 5.64% over the past 24 hours. Despite this decline, key developments and rising whale activity suggest a more positive outlook for UNI’s future.

Read Uniswap Price Prediction for 2025 - 2030

Current Price and Market Trends

UNI is currently above its 50-day Simple Moving Average (SMA) of $5.9265, showing some short-term support. However, it remains below the 200-day SMA at $9.3644, which indicates that the broader recovery is still underway. The circulating supply stands at about 628.7 million UNI tokens, with a healthy 24-hour trading volume exceeding $372 million, reflecting solid market participation.

Spark Launch Boosts Yield Opportunities

Uniswap recently introduced Spark on Unichain, its Layer-2 network powered by Optimism’s OP Stack. This new feature enables native stablecoin yields on USDC, allowing users to earn interest directly within the Uniswap ecosystem. Additionally, Spark Finance is live on Optimism, providing yield options on sUSDS, another stablecoin. These yield tokens can be used across decentralized exchanges (DEXs) and lending markets, increasing utility for UNI holders.

Also Read: Kaspa Price Prediction 2026 – 2030

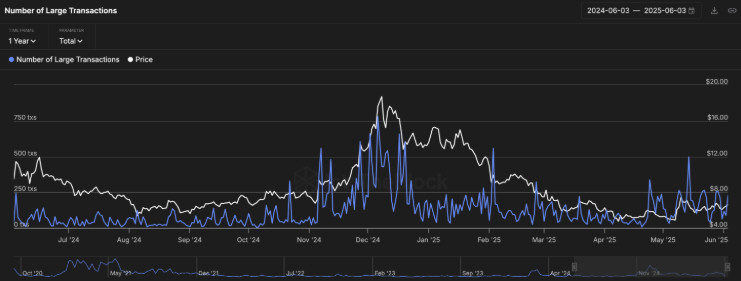

Whale Activity Indicates Institutional Interest

Data from IntoTheBlock shows a significant rise in large UNI transactions over $100,000 in recent weeks. This suggests increased activity from institutional investors or whales. Typically, higher large-volume trades during consolidation phases point to accumulation, which often precedes price rallies.

Summary

While UNI has experienced a short-term price drop, the growing whale activity and the launch of yield-generating features like Spark suggest strong underlying demand. Investors should keep an eye on these trends, as they could signal a potential bullish reversal in the near future.

Comments

0 comment