views

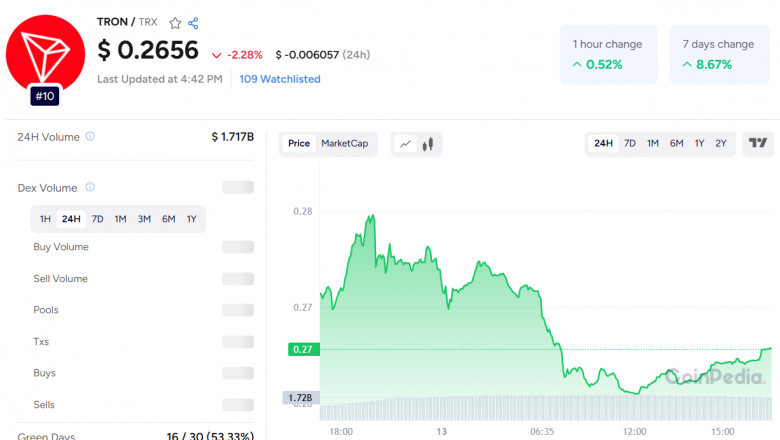

Tron (TRX) posted a sharp 3.07% intraday gain, breaking above the long-standing $0.264 resistance to touch $0.268—a level last tested months ago. This move wasn’t random. It followed a textbook ascending channel pattern, with higher highs and higher lows confirming bullish momentum, strengthening the current Tron price prediction for further upside.

What stands out is the volume spike—over 125 million units traded between 00:00 and 02:00 UTC—hinting at institutional or algorithmic buying. While late-day profit-taking brought prices back to $0.263, the breakout remains intact. The $0.264 level, once resistance, now flips to a dynamic support level.

On the technical front, a golden cross (50-day SMA crossing above the 200-day SMA) is nearing completion, which historically signals the start of sustained bullish trends. If the $0.264 level holds, TRX could test the $0.28–$0.30 range in the next 30 days. Key support sits at $0.238—failure here could trigger a slide to $0.21–$0.22.

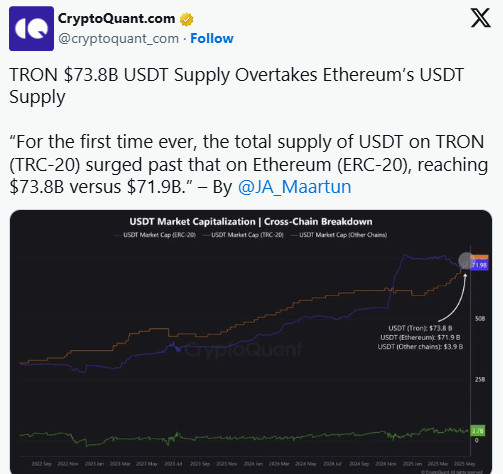

Beyond the chart, Tron is also asserting dominance in the stablecoin space. As of May 6, Tron’s USDT supply surged past Ethereum’s for the first time in nearly two years—$73.8B vs. $71.9B. This shift is driven by Tron’s lower fees, fast finality, and uptime reliability, making it the preferred network for large-scale Tether transactions.

Also Read: VeChain Price Prediction 2025, 2026 – 2030

Tron’s broader ecosystem is also expanding rapidly. Daily transactions top 8.4 million, DEX volume surged 40% in April, and total value locked (TVL) has surpassed $5 billion. New integrations—like USD1 stablecoin and MoonPay's U.S. support—further fuel network adoption.

With technicals aligning and fundamentals strengthening, Tron’s momentum looks far from over. For seasoned crypto investors, the current consolidation zone could be a key accumulation phase before the next leg up.

Comments

0 comment