views

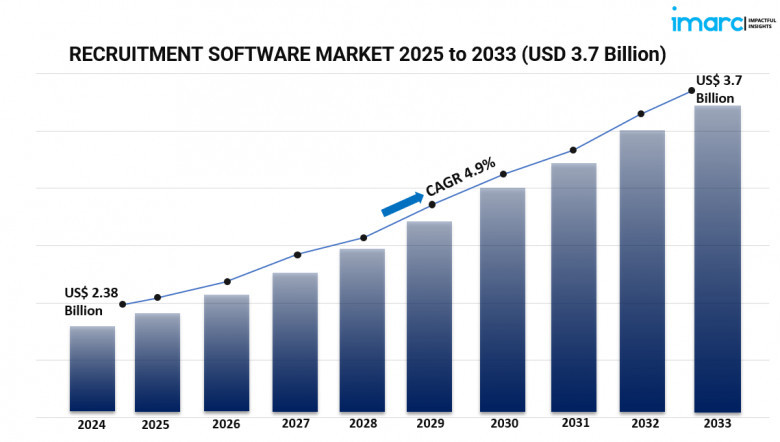

The global recruitment software market is experiencing significant growth, driven by the increasing need for efficient hiring processes and the adoption of advanced technologies. According to IMARC Group, the market reached USD 2.38 billion in 2024 and is projected to grow at a CAGR of 4.9% from 2025 to 2033, reaching USD 3.7 billion by 2033. Key factors fueling this growth include the shift towards cloud-based platforms, the integration of artificial intelligence (AI) and machine learning (ML) in recruitment processes, and the rising demand among small and medium-sized enterprises (SMEs) due to the low maintenance costs of these solutions.

Study Assumption Years:

-

Base Year: 2024

-

Historical Years: 2019-2024

-

Forecast Years: 2025-2033

Recruitment Software Market Key Takeaways:

-

Market Size and Growth: The recruitment software market is projected to grow from USD 2.38 billion in 2024 to USD 3.7 billion by 2033, at a CAGR of 4.9% during 2025-2033.

-

Regional Dominance: North America leads the market, holding a 35.3% share in 2024, driven by the presence of key players and advanced technological adoption.

-

Deployment Model: SaaS-based solutions are gaining traction due to their scalability and cost-effectiveness, especially among SMEs.

-

Component Insights: Software components, including AI-driven analytics and mobile recruitment tools, dominate the market, enhancing the efficiency of hiring processes.

-

Enterprise Size: Large enterprises are the primary adopters, leveraging comprehensive recruitment software suites for scalable hiring needs.

-

Vertical Adoption: Industries such as manufacturing, healthcare, and BFSI are increasingly implementing recruitment software to streamline their hiring processes.

Request for a sample copy of this report: https://www.imarcgroup.com/recruitment-software-market/requestsample

Market Growth Factors:

1. Advances in technology:

The hiring process has been transformed by the integration of artificial intelligence (AI) and machine learning (ML) into recruitment software. These technologies allow chatbots and customized communication for better candidate engagement, predictive analytics for candidate success, and automated résumé screening. Real-time access and flexibility guaranteed by mobile recruiting solutions and cloud-based systems meet the demands of a remote and hybrid staff. These developments not only streamline recruiting processes but also improve the general candidate experience, therefore helping companies to be more competitive in drawing top talent.

2. Regulatory Effects:

Adoption of recruiting software has come to depend mostly on compliance with data privacy rules like GDPR and other national legislation. Features of contemporary recruiting tools guarantee data security, permission management, and compliance reporting. Particularly important for international corporations active across many countries, this is. Making sure companies follow rules reduces legal risks and fosters candidate confidence, which is critical in the data-conscious society of today.

3. Demand on the market:

Rising need for effective and scalable recruiting solutions is fueled by the need to handle great application volumes and simplify hiring procedures. Businesses are looking for software that will easily fit with current HR systems, offer data for wise decision-making, and improve cooperation among recruiting teams. The need for digital recruitment solutions that enable virtual interviews and remote onboarding has been made even more pressing by the move toward remote work; they guarantee continuous hiring procedures independent of geographic limitations.

Market Segmentation:

Breakup by Deployment Model:

-

On-premises: Traditional deployment offering complete control over the software environment, preferred by organizations with stringent data security requirements.

-

SaaS Based: Cloud-based solutions offering scalability, cost-effectiveness, and ease of access, increasingly adopted by SMEs and large enterprises alike.

Breakup by Component:

-

Software:

-

Contact Management: Tools for maintaining and organizing candidate contact information efficiently.

-

Resume Management: Systems for collecting, storing, and analyzing resumes to streamline candidate selection.

-

Mobile Recruitment: Applications enabling recruitment processes through mobile devices, enhancing accessibility and responsiveness.

-

Reporting and Analytics: Features providing insights into recruitment metrics, aiding in data-driven decision-making.

-

Workflow Management: Tools to automate and manage the recruitment workflow, improving process efficiency.

-

Others: Additional software functionalities supporting various aspects of the recruitment process.

-

Services:

-

Professional: Consulting and implementation services to optimize the use of recruitment software.

-

Managed: Outsourced services managing recruitment processes on behalf of the organization.

Breakup by Enterprise Size:

-

Small and Medium-Sized Enterprises: Organizations with limited resources adopting cost-effective and scalable recruitment solutions.

-

Large Enterprises: Organizations with extensive hiring needs requiring comprehensive recruitment software suites.

Breakup by Vertical:

-

Manufacturing: Industries focusing on hiring skilled labor and technical professionals efficiently.

-

Healthcare: Organizations aiming to recruit qualified healthcare professionals swiftly to meet demand.

-

Hospitality: Businesses seeking to manage high-volume hiring and seasonal workforce requirements.

-

BFSI: Financial institutions requiring stringent compliance and specialized talent acquisition.

-

Education: Institutions focusing on hiring qualified educators and administrative staff.

-

Others: Various other industries utilizing recruitment software to enhance their hiring processes.

Breakup by Region:

-

North America (United States, Canada)

-

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

-

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

-

Latin America (Brazil, Mexico, Others)

-

Middle East and Africa

Regional Insights:

North America currently dominates the recruitment software market, holding a 35.3% share in 2024. This leadership is attributed to the presence of major market players, advanced technological infrastructure, and the early adoption of innovative recruitment solutions. The region's focus on enhancing candidate experience and streamlining hiring processes continues to drive the demand for sophisticated recruitment software.

Recent Developments & News:

The recruitment software market is witnessing continuous innovation, with companies integrating AI and ML to enhance candidate screening and matching processes. The shift towards remote work has led to the development of features supporting virtual interviews and remote onboarding. Additionally, there is a growing emphasis on improving the candidate experience through user-friendly interfaces and personalized communication. These advancements are reshaping the recruitment landscape, making it more efficient and candidate-centric.

Key Players:

-

Accenture Plc

-

ADP LLC

-

Ceridian HCM Inc.

-

Cognizant Technology Solutions

-

Cornerstone OnDemand

-

iCIMS

-

Kenexa Corporation (IBM)

-

Oracle

-

PeopleAdmin

-

SAP

-

SumTotal Systems Inc.

-

Zoho Corpo