views

Peritoneal Dialysis Equipment Market Growth with Automated Cycler Technology

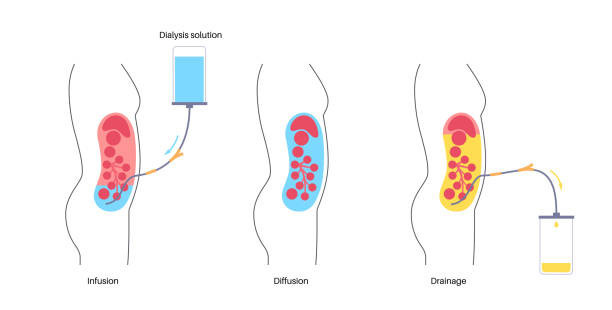

Peritoneal dialysis equipment comprises automated cyclers, manual systems, dialysate solutions and catheters designed to facilitate fluid exchange across the peritoneum in patients suffering from chronic kidney disease (CKD). These devices offer the advantages of home-based therapy, reduced dependence on hospital infrastructure and improved patient quality of life. Automated cycler technology allows for precise control of dialysate fill and drain cycles during nighttime treatment, minimizing human error and enabling consistent regimens. Manual exchanges remain a cost-effective option in resource-limited settings, while advanced heparin-coated catheters reduce infection risk and extend device lifespan.

Digital monitoring modules and remote connectivity options enable clinicians to receive real-time treatment data, enhancing patient safety and adherence. As healthcare systems aim to lower costs and optimize resource allocation, Peritoneal Dialysis Equipment Market products meet the rising need for decentralized care. Supportive reimbursement policies, ongoing product innovations and expanding home healthcare services drive business growth, underscored by thorough market research and evolving market trends. Emerging economies, with growing industry size and shifting demographics, present untapped market opportunities for device manufacturers.

The peritoneal dialysis equipment market is estimated to be valued at USD 4.91 Bn in 2025 and is expected to reach USD 7.48 Bn by 2032, growing at a compound annual growth rate (CAGR) of 6.2% from 2025 to 2032.

Key Takeaways

Key players operating in the Peritoneal Dialysis Equipment Market are:

-Baxter International Inc.

-Fresenius Medical Care AG & Co. KGaA

-Terumo Corporation

-Medtronic plc

-Utah Medical Products, Inc

The market offers significant opportunities as the prevalence of end-stage renal disease climbs globally. Growing awareness of home-based treatment models, combined with supportive policy frameworks and rising healthcare expenditure, fuels demand. Telehealth integration and digitized patient monitoring open new market opportunities for connected devices and subscription-based service models. Expansion in Asia Pacific and Latin America, driven by increasing screening programs and healthcare infrastructure investments, points to a robust market forecast.

Technological advancement in automated cycler systems continues to reshape the landscape. Automated Cycler Technology, featuring algorithm-driven fluid control and remote analytics, reduces manual intervention and enhances treatment precision. Future innovations may integrate AI for predictive maintenance and personalized therapy adjustments, strengthening overall treatment outcomes and reinforcing market growth.

Market drivers

One of the primary market drivers is the rising global incidence of chronic kidney disease (CKD) fueled by aging populations, diabetes and hypertension. As CKD prevalence increases, the demand for renal replacement therapies intensifies, propelling market growth. Peritoneal dialysis equipment serves as a flexible and cost-effective alternative to hemodialysis, especially in regions with limited hospital capacity. Health systems seeking to manage rising care costs are adopting home-based solutions that reduce patient hospitalization while preserving quality of life. Innovations in dialysate formulation and device ergonomics have made treatment more patient-friendly, accelerating adoption among both healthcare providers and end users. Additionally, increased investment in healthcare infrastructure and favorable reimbursement policies in key markets support broader access to peritoneal dialysis. This combination of clinical need, economic pressure and technological refinement underscores the strong demand and sustained expansion of the peritoneal dialysis equipment market.

Challenges, SWOT Overview and Geographical Regions

The peritoneal dialysis equipment market faces multiple market challenges driven by evolving patient needs, regulatory requirements, and reimbursement complexities. Despite growing awareness of home-based therapies, restrictive policies and limited insurance coverage remain significant market restraints. Manufacturers must navigate intricate approval pathways while responding to shifting industry trends such as automation, telemonitoring integration and patient-centric design. Market research indicates that supply chain disruptions, including raw-material shortages and logistics bottlenecks, further strain production timelines and inflate costs. Developing robust market growth strategies that address these market dynamics is critical to sustaining business growth and maintaining competitive market share.

A high-level SWOT overview highlights the landscape: the strength of a strong innovation pipeline and established clinical efficacy contrasts with weaknesses like dependence on specialized training and higher upfront device costs. Opportunities lie in expanding adoption across emerging regions and tapping into digital health solutions, while threats originate from alternative renal replacement methods, looming pricing pressures and potential policy shifts impacting reimbursement.

Geographically, North America holds a significant proportion of total market valuation due to early technology adoption, well-established healthcare infrastructure and favorable reimbursement frameworks. Europe follows closely, supported by an aging population and increasing incidence of end-stage renal disease. In Asia Pacific, improving healthcare access and government initiatives to broaden dialysis coverage generate promising market opportunities. Latin America and Middle East & Africa remain nascent but show high potential for future expansion with rising healthcare expenditure and growing market awareness.

This fragmented competitive environment demands detailed market analysis and ongoing market insights to craft targeted strategies. Manufacturers and distributors must leverage advanced analytics, real-world data and ecosystem partnerships to drive product innovation, optimize cost structures and accelerate time-to-market. With heightened focus on patient convenience and remote monitoring, the peritoneal dialysis equipment sector is poised for transformation—but only if industry players can address prevailing market restraints and capitalize on emerging market trends.

Current Challenges

The peritoneal dialysis equipment industry currently grapples with several hurdles that impact its trajectory. Stringent regulatory pathways across regions often elongate product approval cycles, delaying launches and limiting market access. Simultaneously, fluctuating reimbursement policies create uncertainty for providers and end users, constraining uptake of advanced automated cyclers. Supply chain disruptions—exacerbated by global logistics challenges—lead to intermittent shortages of critical components such as fluid connectors and biocompatible tubing. This drives up costs and undermines reliable delivery.

Training requirements for both clinicians and patients pose another barrier. Home-based therapy success hinges on patient education, yet limited access to skilled nurses and inconsistent training programs can diminish adherence and clinical outcomes. Moreover, the industry faces competition from alternative modalities like hemodialysis and emerging wearable devices. Price sensitivity in emerging markets further restrains revenue growth strategies, compelling manufacturers to explore cost-effective designs without compromising quality. Addressing these market drivers and market restraints through robust market research and stakeholder collaboration is essential to surmount current challenges and unlock sustainable expansion.

SWOT Analysis

Strength: A proven track record of clinical efficacy and patient convenience underpins strong brand equity. Advanced automated cyclers and user-friendly disposables drive positive patient outcomes and foster physician trust.

Weakness: High initial device costs and ongoing supply-chain dependencies inflate total therapy expenses, limiting adoption in cost-sensitive regions. Complex training protocols for home use can reduce patient adherence and increase support demands.

Opportunity: Expanding digital health integration and remote patient monitoring opens new avenues for personalized care and therapy optimization. Growing awareness of home-based treatment modalities in emerging economies presents untapped market opportunities for equipment manufacturers.

Threats: Intensifying competition from alternative renal therapies and potential policy shifts affecting reimbursement could erode profitability. Raw material price volatility and disruptive supply-chain events pose risks to consistent production and timely deliveries.

Value Concentration by Region

North America dominates peritoneal dialysis equipment value concentration, accounting for a substantial industry share due to advanced healthcare infrastructure, favorable reimbursement frameworks and strong regional investment in renal care. The United States leads uptake, driven by patient preference for home-based dialysis and robust insurance coverage that supports capital-intensive automated peritoneal dialysis systems. Canada contributes through provincial health programs and growing adoption of continuous ambulatory peritoneal dialysis. Europe holds the second-largest share, led by Germany, France and the U.K., where national renal initiatives and aging demographics propel demand. Established distribution networks and partnerships between local market players and global device manufacturers ensure broad product availability and prompt customer support. Asia Pacific’s mature markets such as Japan and Australia also contribute materially, benefiting from high per capita healthcare spending and government incentives to expand peritoneal dialysis centers. In contrast, Latin America and Middle East & Africa account for smaller shares but are steadily growing as public–private collaborations improve dialysis access and infrastructure.

Fastest-Growing Region

Asia Pacific emerges as the fastest-growing region for peritoneal dialysis equipment, underpinned by expanding healthcare coverage and rising prevalence of chronic kidney disease across China, India and Southeast Asian nations. Government initiatives to bolster home-based dialysis options and strategic partnerships with local companies have accelerated market growth. Enhanced training programs for healthcare professionals and patient education campaigns are increasing therapy adoption rates. Furthermore, improving hospital infrastructure and growing medical tourism bolster demand for advanced peritoneal dialysis systems. Regional market dynamics showcase a shift from hospital-centric models toward home care, supported by digital monitoring platforms and telehealth services that align with evolving patient preferences. Affordability enhancements—such as leasing programs and bundled pricing—address cost sensitivities and broaden the therapy’s reach. As regulatory bodies streamline approval processes and international manufacturers establish local production facilities, the Asia Pacific region is poised to sustain its rapid expansion trajectory, capturing a larger share of global market revenue in the years ahead.

‣ Get this Report in Japanese Language: 腹膜透析装置市場

‣ Get this Report in Korean Language: 복막투석장비시장

About Author:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191)