views

Market Overview

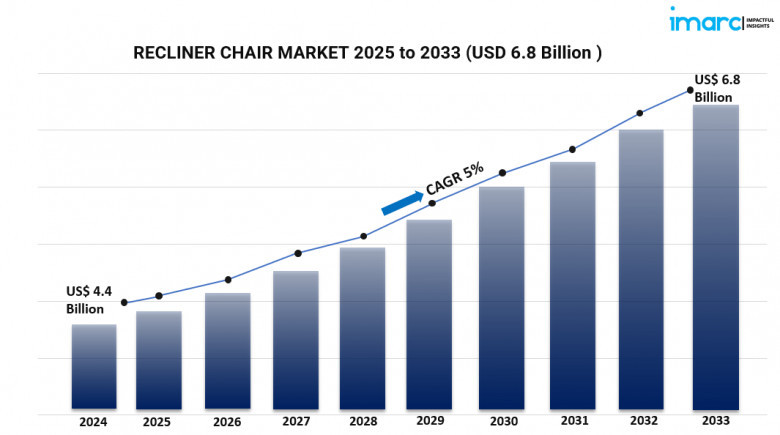

The global recliner chair market is experiencing robust growth, driven by increasing consumer emphasis on home comfort and wellness. Valued at USD 4.4 billion in 2024, the market is projected to reach USD 6.8 billion by 2033, growing at a CAGR of 5% from 2025 to 2033. Key factors propelling this growth include advancements in smart home technologies, a surge in real estate development, and a rising demand for ergonomic and luxury furniture solutions.

Study Assumption Years

-

Base Year: 2024

-

Historical Years: 2019-2024

-

Forecast Years: 2025-2033

Recliner Chair Market Key Takeaways

-

Market Size & Growth: The market reached USD 4.4 billion in 2024 and is expected to grow to USD 6.8 billion by 2033, at a CAGR of 5%.

-

Dominant Product Type: Wall hugging recliners lead the market due to their space-saving design, catering to urban living spaces.

-

Seating Arrangement: Single seater recliners dominate, favored for their versatility and suitability for compact living areas.

-

Material Preference: Leather recliners are most popular, appreciated for their durability and premium aesthetic.

-

Distribution Channels: Furniture and furnishing stores are the primary sales channels, offering consumers a wide range of options.

-

End-User Segment: The commercial sector holds the largest market share, with recliners increasingly used in cinemas, offices, and healthcare facilities.

-

Regional Leadership: North America leads the market, driven by high consumer spending and a strong preference for comfort-centric furniture.

Request for a sample copy of this report : https://www.imarcgroup.com/recliner-chair-market/requestsample

Market Growth Factors

1. Tech developments in recliner chairs

Sophisticated technology incorporation into recliner chairs has greatly increased their appeal. Modern recliners today have massage functions, heating elements, adjustable headrests, and even intelligent connectivity possibilities. These technologies satisfy consumers' increasing need of multifunctional furniture that combines comfort with usefulness. With manufacturers spending in R&D to include characteristics like zero-gravity positioning and built-in USB ports, recliners are becoming more adaptable and attractive to a larger audience.

2. Growing Lifestyle and Wellness Trend Influence

Consumer preferences have been shaped by the rising focus on health and wellness, which has generated greater demand for furniture encouraging a healthy lifestyle. Given their ergonomic designs and therapeutic elements, recliner chairs fit nicely with this trend. Recliners are a common choice among health-conscious consumers since features like lumbar support, massage systems, and heating components help to relieve stress and enhance posture.

3. Growth of Internet Retail Outlets

The emergence of several e-commerce sites has changed the furniture retail scene. Online retailers give customers the ease of buying and browsing reclining chairs from the cosiness of their house. Virtual showrooms, thorough product descriptions, and consumer comments help to improve the internet buying experience. Moreover, further expanding the market for recliners, competitive pricing and internet promotion specials have made them more widely available to a smaller population.

Market Segmentation

Breakup by Product Type:

-

Wall Hugging Recliner: Designed to save space by reclining forward, ideal for compact living areas.

-

Push Back Recliner: Operated by leaning back, offering a sleek design without levers or buttons.

-

Massage Recliner: Equipped with built-in massage functions for enhanced relaxation.

-

Riser Recliner: Features a lift mechanism to assist users in standing up, beneficial for the elderly.

-

Others: Includes various other recliner types catering to specific consumer needs.

Breakup by Seating Arrangement:

-

Single Seater Recliner: Designed for individual use, offering personalized comfort.

-

Multi Seater Recliner: Accommodates multiple users, suitable for family or group settings.

Breakup by Material:

-

Leather: Premium material known for durability and a luxurious feel.

-

Fabric: Offers a variety of textures and colors, providing a cozy and versatile option.

-

Others: Includes synthetic materials and blends catering to diverse consumer preferences.

Breakup by Distribution Channel:

-

Furniture and Furnishing Stores: Physical retail outlets offering a wide range of recliner options.

-

Hypermarkets: Large retail spaces providing recliners alongside other household items.

-

E-Retailers: Online platforms facilitating convenient shopping experiences.

-

Others: Includes specialty stores and direct-to-consumer channels.

Breakup by End-User:

-

Residential: Recliners used in homes for personal comfort and relaxation.

-

Commercial: Utilized in offices, cinemas, and healthcare facilities to enhance user experience.

-

Others: Encompasses various other applications across different sectors.

Breakup by Region:

-

North America (United States, Canada)

-

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

-

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

-

Latin America (Brazil, Mexico, Others)

-

Middle East and Africa

Regional Insights

North America dominates the recliner chair market, attributed to high consumer spending on home furnishings and a strong preference for comfort-centric furniture. The region's well-established retail infrastructure and rapid adoption of technological advancements in furniture design further bolster market growth.

Recent Developments & News

In April 2023, American Leather Holdings rebranded as Artisant Lane, overseeing a diverse portfolio of furniture manufacturers. Ekornes ASA introduced the Stressless Sky mattress, marking its entry into the American market. Inter IKEA Systems B.V. invested in Nilo Ltd., focusing on developing non-toxic adhesives from waste plastics, emphasizing sustainability in furniture manufacturing.

Key Players

-

American Leather

-

Anji Jinkun Furniture

-

Ashley Home Stores, Ltd.

-

Ekornes ASA

-

Heritage Home Group

-

Inter IKEA Systems B.V.

-

La-Z-Boy Incorporated

-

Macy’s

-

Man Wah Holdings Limited

-

Natuzzi S.p.A

-

Steinhoff International Holdings

-

Williams-Sonoma, Inc.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=1999&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.