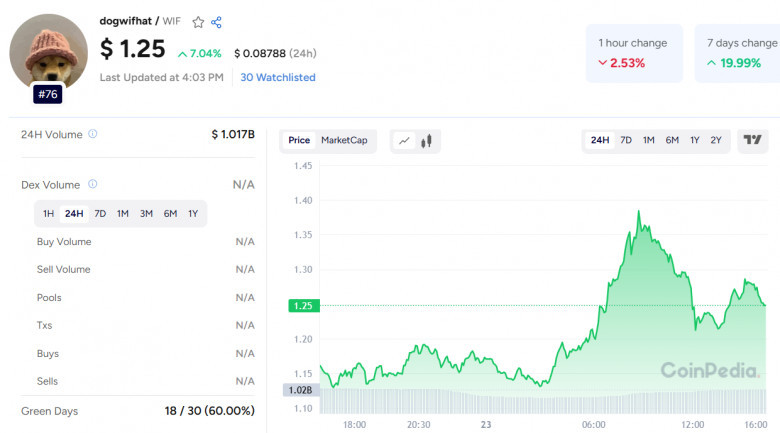

The price has hovered near the $1.18–$1.21 zone for several days. Despite Bitcoin reaching new all-time highs and many altcoins seeing strong rallies, WIF has not yet broken out. It remains inside a sideways range, with $1.07 acting as the mid-point.

-

The On-Balance Volume (OBV) is slowly trending upward, suggesting some buyer interest, but hasn’t crossed previous highs.

-

Trading volume has increased slightly over the last 24 hours but does not yet signal strong breakout momentum.

Liquidity Could Attract Price Higher

According to Coinglass, there is a cluster of liquidity between $1.2 and $1.26. This suggests price may soon move toward this zone, as liquidity often acts like a magnet. If WIF can break above $1.26 and flip this area into support, a larger rally could begin. The next resistance lies near $1.31—an area that previously caused a rejection in early May.

Also Read: Optimism Price Prediction 2025, 2026 – 2030

Derivatives Show Growing Interest

Open Interest and trading volume in the WIF derivatives market are rising, reflecting stronger investor participation. Recent liquidation data shows that $1.44 million in shorts were wiped out, compared to $996,000 in long positions. This imbalance could lead to more upside if short sellers continue to get squeezed.

Conclusion:

WIF is at a make-or-break level. A successful move past $1.26, with strong volume and a support retest, could be the start of a fresh uptrend. For experienced crypto investors, this setup is worth watching closely.

Comments

0 comment