views

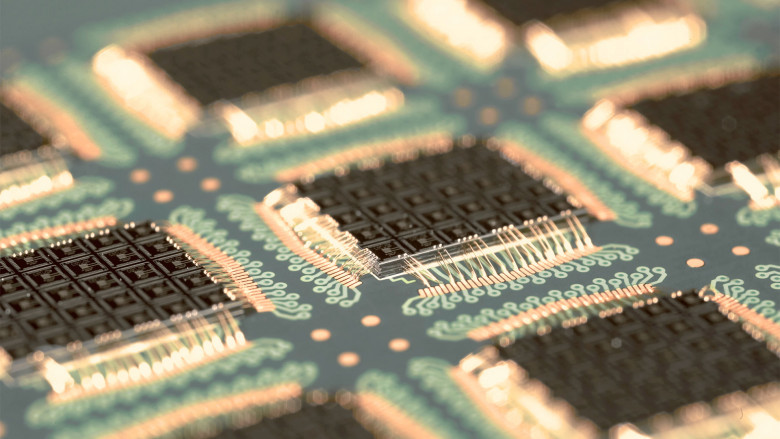

Advanced Semiconductor Packaging Market to Soar Owing to AI Demand

The Advanced Semiconductor Packaging Market encompasses a suite of cutting-edge interconnection and assembly processes designed to enhance the performance, reliability, and miniaturization of semiconductor devices. These packaging solutions include fan-out wafer-level packaging (FOWLP), 2.5D/3D integrated circuits, system-in-package (SiP), and through-silicon via (TSV) technologies that enable higher input/output (I/O) density, improved thermal management, and reduced form factors.

By leveraging advanced materials such as high-performance laminates, micro-bump arrays, and novel underfill resins, companies can achieve superior electrical integrity and signal speed crucial for applications in artificial intelligence, 5G telecommunications, and automotive electronics. As semiconductor nodes shrink below 10 nm, the need for sophisticated packaging intensifies to mitigate parasitic effects and ensure seamless heat dissipation. In addition, greater adoption of heterogeneous integration is driving demand for multi-die assemblies that combine logic, memory, and sensors within a single package. These innovations not only bolster product differentiation but also support the Advanced Semiconductor Packaging Market rapid business growth.

The advanced semiconductor packaging market is estimated to be valued at USD 41.61 Bn in 2025 and is expected to reach USD 72.24 Bn by 2032, growing at a compound annual growth rate (CAGR) of 8.2% from 2025 to 2032.

Key Takeaways

Key players operating in the Advanced Semiconductor Packaging Market are:

-Advanced Micro Devices, Inc.

-Intel Corporation

-Hitachi, Ltd.

-ASE Technology Holding Co., Ltd.

-Amkor Technology

These market companies drive innovation through substantial R&D investments and strategic partnerships, maintaining a robust market share across Asia Pacific, North America, and Europe. Together, these firms contribute to the market dynamics by introducing next-generation fan-out solutions and scaling their wafer-level packaging lines to address accelerating demand in high-performance computing and edge-AI applications. Their combined industry share and collaborative initiatives in supply chain integration underline the competitive landscape detailed in leading market reports.

Growing demand for advanced packaging is fueled by the proliferation of data-intensive applications and escalating requirements for smaller, more energy-efficient devices. Key market drivers include the rollout of 5G networks, which calls for compact, multi-band radio frequency modules, and surging uptake of electric vehicles, where rugged power modules rely on sophisticated thermal solutions. In addition, the boom in cloud computing and data centers is creating pressure to boost performance-per-watt metrics, driving growth in 2.5D and 3D IC packaging. The emphasis on reducing time-to-market and optimizing supply chain resilience reinforces the market growth trajectory and underlines the importance of market research and market insights in formulating effective market growth strategies.

Technological advancement in the Advanced Semiconductor Packaging Market is centered around heterogeneous integration and advanced interconnect architectures. Innovations such as embedded bridge substrates enable ultra-fine line dielectric thickness and high-density interconnects, while through-silicon via (TSV) technologies facilitate vertical stacking of memory and logic dies. Fan-out wafer-level packaging continues to evolve, with next-gen platforms offering optimized redistribution layers and lower warpage risk. Furthermore, the integration of silicon photonics and micro-electromechanical systems (MEMS) within packaging ecosystems expands functional scope, enabling new market segments in optical communications and biosensing. These technological strides are key themes in market analysis and shape the future market forecast.

Market trends

The first major trend is the shift toward heterogeneous integration, where multiple chiplets—logic, memory, sensors—are co-packaged to overcome scaling limits. This trend addresses market challenges by enhancing performance and reducing latency, and is critical for AI accelerators and high-bandwidth memory modules. The second key trend is the widespread adoption of fan-in and fan-out wafer-level packaging, which offers a cost-effective alternative to traditional BGA (ball grid array) packages. FOWLP enables thinner profiles and better thermal performance, catering to wearables and ultra-thin mobile devices. Both trends reflect ongoing market dynamics emphasizing miniaturization, performance, and thermal management, as highlighted in recent market report summaries.

Market Opportunities

One significant opportunity lies in the expansion of 5G and beyond-5G infrastructure. As telecom operators deploy small cells and edge data centers, there is a burgeoning need for compact multi-chip modules that integrate RF front-ends, power amplifiers, and baseband processors. Advanced semiconductor packaging players can capitalize on this by offering customized system-in-package solutions tailored for high-frequency applications. A second opportunity emerges from the automotive sector’s pivot to autonomous driving and electric vehicles. High-voltage power modules and sensor arrays in ADAS systems demand robust thermal solutions and high-reliability packaging. By developing advanced underfill materials and silicon carbide (SiC) compatible packages, market players can drive new revenue streams and broaden their market scope in this rapidly evolving industry segments.

Impact of COVID-19 on Advanced Semiconductor Packaging Market Growth

Prior to the pandemic, the Advanced Semiconductor Packaging Market exhibited robust momentum, driven by rising demand for 5G-enabled devices, high-performance computing platforms and consumer electronics. Market drivers included rapid technological advances in heterogeneous integration and increasing adoption of fan-out wafer-level packaging. Supply chains were lean, agile and optimized for just-in-time manufacturing. Detailed market insights highlighted strong collaboration between substrate suppliers, foundries and assembly houses, resulting in healthy industry size expansion and attractive market opportunities. Manufacturers placed heavy emphasis on yield enhancement and cost reduction, leveraging in-line inspection tools and AI-driven process controls.

When COVID-19 struck, major disruptions emerged across the global electronics value chain. Lockdowns in key manufacturing hubs led to capacity idling and shipment delays, triggering tool shortages and longer lead times. Work-from-home mandates boosted demand for data centers and network infrastructure, partially offsetting declines in mobile handset upgrades. However, intermittent plant closures exposed underlying market challenges in logistics, labor availability and raw-material sourcing. The need for resilient supply-chain architecture became apparent, and firms began to re-evaluate risk management strategies through scenario planning and dual-sourcing models.

In the post-COVID landscape, industry participants are charting revised market growth strategies. Emphasis has shifted toward flexible capacity planning, digital transformation initiatives and greater automation to minimize human intervention. Advanced packaging houses are exploring collaborative ecosystems with OSATs, foundries and equipment vendors to accelerate time-to-market for emerging architectures such as 2.5D interposers and chiplet-based designs. Future tactics will prioritize predictive analytics for yield optimization, on-shoring of critical processes, and investment in green manufacturing techniques. This multi-pronged approach is expected to strengthen overall market dynamics and unlock sustainable business growth despite lingering uncertainties.

Geographical Regions with Highest Value Concentration

Asia Pacific stands out as the principal region in terms of value concentration for the Advanced Semiconductor Packaging Market. A major share of global assembly and test operations is headquartered in China, Taiwan, South Korea and Japan, where state-of-the-art fabs are complemented by specialized OSAT (outsourced semiconductor assembly and test) service providers. This region’s strong industry size is underpinned by favorable government policies, extensive infrastructure investment and a deep talent pool. Market research indicates that more than half of worldwide advanced packaging revenue is generated here, reflecting significant market share and industry share in fine-pitch fan-out and 3D integration technologies.

North America holds the second-largest value concentration, fueled by its leading-edge R&D activities and presence of major IDM (integrated device manufacturers) players. The U.S. benefits from robust capital expenditure in digitalization, automotive electronics and defense applications. Europe also commands a noteworthy portion of market revenue, with Germany and France focusing on specialized automotive and industrial use cases, supported by stringent quality standards and environmental regulations. In each of these regions, detailed market analysis points to sizeable investments in machine-learning-enabled inspection systems, high-density interconnect substrates and advanced materials research.

Across all regions, common market challenges include talent shortages, trade policy uncertainties and supply‐chain bottlenecks for specialty chemicals and substrates. Nevertheless, the Asia Pacific and North American hubs continue to offer the most compelling market opportunities for players looking to scale capacity, form strategic alliances and capitalize on emerging demand for heterogeneous integration.

Fastest Growing Region for Advanced Semiconductor Packaging

The Asia Pacific region not only concentrates the highest value but also represents the fastest growing territory for advanced semiconductor packaging technologies. Within this area, emerging economies such as India, Vietnam and Malaysia are witnessing accelerated expansion due to aggressive government incentives, establishment of electronics manufacturing clusters and growing domestic demand for consumer and automotive electronics. Market drivers include lower labor costs, proximity to raw-material sources and enhanced logistics networks. Recent market insights highlight that these emerging hubs are rapidly reducing dependence on traditional centers by attracting foreign direct investment and fostering local OSAT ecosystems.

Latin America is also emerging as a promising frontier, albeit on a smaller base. Brazil and Mexico have ramped up incentives for semiconductor-related infrastructure, positioning themselves as alternative assembly locations. These markets are showcasing double-digit annual growth rates, buoyed by nearshoring trends and automotive electrification. Demand for multi-chip modules and system-in-package solutions in this region is rising sharply, creating new market opportunities for equipment suppliers and materials vendors seeking to diversify geographic risk.

Meanwhile, Eastern Europe and the Middle East are gradually carving niches in advanced packaging. Hungary and Israel are developing capabilities in wafer-level packaging, while the UAE and Saudi Arabia explore joint ventures with global OSAT leaders. Across all fast-expanding regions, companies are adopting dynamic market growth strategies such as local talent development programs, modular fab expansions and digital twins for process validation. These initiatives aim to mitigate market restraints, enhance yield performance and capture a larger slice of the booming global demand for high-performance semiconductor assemblies.

‣ Get More Insights On: Advanced Semiconductor Packaging Market

‣ Get this Report in Japanese Language: 先端半導体パッケージ市場

‣ Get this Report in Korean Language: 첨단반도체패키징시장

About Author:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191)

Comments

0 comment