views

As the Financial Year (FY) 2024–25 comes to a close, taxpayers should prepare for the Assessment Year (AY) 2025–26. The Central Board of Direct Taxes (CBDT) has introduced updates to simplify the Income Tax Return (ITR) filing process and improve transparency. These changes will affect how salaried individuals, professionals, and business owners plan, calculate, and report their income. This guide provides a comprehensive key to updates, revised tax slabs, filing conditions, and deadlines to help you file confidently and avoid penalties.

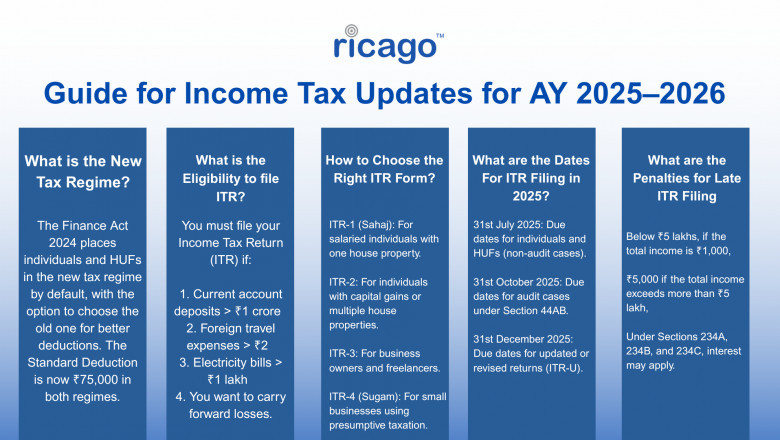

What is the New Tax Regime?

As per the Finance Act 2024, individuals and Hindu Undivided Families (HUFs) are automatically under the new tax regime, but you may opt out to continue with the old regime, which offers better deductions and exemptions for you.

The Standard Deduction has increased from ₹50,000 to ₹75,000 in both regimes, and updated tax slabs under the new regime offer lower rates but remove most exemptions.

In Financial Year (FY) 2025–26 (Assessment Year 2026–27)

Rebate Threshold: ₹12,00,000

Maximum Rebate: ₹60,000

As per the Union Budget 2025, for FY 2025–26, individual residents with a taxable income up to ₹12 lakh can receive a rebate of up to ₹60,000 under Section 87A.

What is the Eligibility to file ITR?

Even if your income is below the taxable limit, you are still required to file your Income Tax Return (ITR) is mandatory if:

If your deposits in one or more current accounts is more than ₹1 crore.

If your foreign travel expenses is more than ₹2.

If you are paying Electricity bills more than ₹1 lakh.

If you wish to carry forward capital losses or losses under "Income from Other Sources".

How to Choose the Right ITR Form?

ITR-1 (Sahaj):

This ITR 1 (Sahaj) is for salaried individuals with income from one house property and other sources.

ITR-2:

This is for people who have income from capital gains or multiple house properties and don’t have income from business or profession

ITR-3:

This is for those who earn from a business or profession, including freelancers, consultants, and business owners

ITR-4 (Sugam):

This is for small businesses or professionals using the presumptive taxation scheme, including individuals, HUFs, and firms (except LLPs)

What are the Dates For ITR Filing in 2025?

These are the important dates for filing ITR in 2025 are given below:

31st July 2025: Due dates for individuals and HUFs (non-audit cases).

31st October 2025: Due dates for audit cases under Section 44AB.

31st December 2025: Due dates for updated or revised returns (ITR-U).

What are the Penalties for Late ITR Filing?

The penalties for filing ITR late in 2025 are given below:

Below ₹5 lakhs, if the total income is ₹1,000,

₹5,000 if the total income exceeds more than ₹5 lakh,

Under Sections 234A, 234B, and 234C, interest may apply.

What are the Compliance Tips for ITR Filing?

To make seamless Income Tax Return (ITR) filing, maintain accurate records of your income, expenses, and investments throughout the year. Verifying Form 26AS and AIS/TIS with the financial data to confirm all tax credits and transactions are correct. Claim eligible under sections 80C (investments), 80D (health insurance), and 80G (donations) to reduce your tax liability. Always utilize the official Income Tax e-filing portal for a secure process. Lastly, review the pre-filled data and verify third-party information to prevent mismatches and possible notices.

Conclusion

The revised Income Tax Return (ITR) rules for assessment year 2025–26 aim to simplify the filing process, reduce errors, and promote voluntary compliance. By preparing in advance, ensuring accurate documentation, and selecting the right ITR form, taxpayers can navigate and adapt to these changes, maximizing the available benefits.

At Ricago, we empower individuals and businesses with automated compliance tools that help you stay up to date with the latest tax regulations and allow you to file your returns with confidence. Let Ricago simplify your compliance journey because effective tax planning begins with the right support.

Comments

0 comment