views

China Luxury Car Market Overview

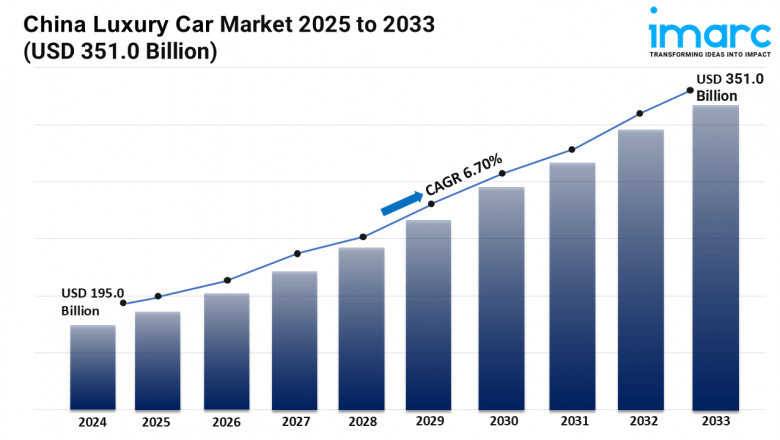

Market Size in 2024: USD 195.0 Billion

Market Forecast in 2033: USD 351.0 Billion

Market Growth Rate: 6.70% (2025-2033)

According to the latest report by IMARC Group, the China luxury car market size was valued at USD 195.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 351.0 Billion by 2033, exhibiting a CAGR of 6.70% from 2025-2033.

China Luxury Car Industry Trends and Drivers

Rapid growth is being witnessed in the luxury car market in China, courtesy of several factors. One such factor is rising disposable income within the country. More and more consumers have financial power and are gravitating towards luxury automobiles to flaunt status and a premium lifestyle. This burgeoning wealth is creating a demand for high-end automobiles, as consumers are willing to pay for better quality, technology, and considerable features. The consumers in China associate luxury cars with prestige and a symbol of success. Therefore, the increasing number of middle and upper-income groups has a relevant role to play in the market growth.

The growth of the luxuriously-priced cars market in China, on the other hand, can also be attributed to technological advancements. Innovations are on the way from manufacturers as they continually meet the growing demand for the latest features such as autonomous driving, electric propulsion systems, and enhanced connectivity. Coupled with the rapid advancement in electric vehicles (EVs) and new energy vehicles (NEVs), consumer interests did soar. The incentive from different governments to employing eco-friendly technologies compels luxury car brands to build hybrid and fully electric models in their product line, targeting a growing number of green consumers. Furthermore, vehicle safety, fuel efficiency, and performance enhancements continue to drive consumers toward more exclusive luxury cars, where innovation counts the most along with comfort and design.

Technology is growing as well, and such advances continue to fuel growth in the luxury car market in China. Manufacturers innovate continuously to meet the growing demand for the latest features such as autonomous driving, electric propulsion systems, and enhanced connectivity. Consumer interests soared further with the rapid advancement of electric vehicles (EVs), mainly new energy vehicles (NEVs). The incentive of so many governments for employing eco-friendly technologies is a compulsion to many luxury car names for producing hybrids and even fully electric models in their range of products, showing a growing number of green consumers. Moreover, improvements with regard to safety features for the vehicle, fuel efficiency, and performance, make luxury cars even more attractive to the discerning consumer who values more innovation with his comfort and design.

Rapidly enlarging networks of luxury car dealerships and after-sales services across China today play a significant role in market growth. As luxury car brands establish firms in first and second-tier cities, they are providing better access to these vehicles for potential customers. Such widespread availability makes it easier for customers to view and purchase premium models, avail themselves of luxury service offerings, and engage in brand experience. All in all, improved sales and service infrastructure therefore stimulates the growth of the luxury car market by allowing better purchase and service access to high-end automobiles for customers. Thus, the market is witnessing unprecedented growth alongside a fine portfolio of various models, price sections, and fuel types catering to versatile consumer needs.

Download sample copy of the Report: https://www.imarcgroup.com/china-luxury-car-market/requestsample

China Luxury Car Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Vehicle Type:

- Hatchback

- Sedan

- Sports Utility Vehicle

Analysis by Fuel Type:

- Gasoline

- Diesel

- Electric

Analysis by Price Range:

- Entry-Level

- Mid-Level

- High-End

- Ultra

Analysis by Engine Capacity:

- Up to 3,000 CC

- Above 3,000 CC

Regional Analysis:

- Guangdong

- Jiangsu

- Zhejiang

- Henan

- Sichuan

- Shanghai

- Others

Competitive Landscape:

Luxury brands like BMW, Mercedes-Benz, and Audi are increasing local production to reduce costs and meet Chinese consumer preferences. Joint ventures with domestic manufacturers, such as BMW’s partnership with Brilliance Auto, allow these brands to optimize production and offer tailor-made models. Customization services, including exclusive interior designs, premium materials, and personalized features, are also becoming a key focus to cater to China’s growing demand for unique luxury experiences. With China’s strong push for electric vehicles (EVs), luxury carmakers are aggressively investing in electrification. Brands like Tesla, NIO, and Porsche are introducing high-performance EVs with extended range and cutting-edge autonomous driving capabilities. According to CarNewsChina, which cited preliminary sales figures from the China Passenger Car Association (CPCA), EV manufacturers sold a record 10.97 million new energy vehicles (NEVs) in China in 2024. Additionally, smart connectivity features, AI-assisted driving, and advanced infotainment systems are becoming essential offerings to attract tech-savvy Chinese buyers. As per China luxury car market forecast, these efforts continue to drive the market growth.

The report provides a comprehensive analysis of the competitive landscape in the China luxury car market with detailed profiles of all major companies.

Latest News and Developments:

- In January 2025, In China, Chery introduced the luxury off-road brand Jetour Zongheng. In the third quarter of this year, the Jetour Zongheng G700, the brand's debut model, will be released in China. Later, domestic sales of the F700 pickup truck and the 1,572-hp G900 SUV will begin.

- In April 2024, in an effort to attract affluent customers amid a growing pricing war among some of the nation's leading EV manufacturers, Chinese manufacturer Nio unveiled the Nio 2024 ET 7. William Li Bin, claims that the new executive car has more potent smart-driving capabilities, an improved digital cockpit, long driving range, and more comfy passenger seats.

- In January 2025, Great Wall Motor (GWM) is getting ready to introduce "Confidence Auto," a new luxury new energy vehicle brand. The new brand is anticipated to directly compete with BYD's Yangwang brand and will be positioned higher than current brands such as Haval, WEY, Tank, and Ora.

- In September 2024, The Dongfeng Forthing brand unveiled the Xinghai S7, an electric sedan/hatchback. Each of the three models has a 555-kilometer range.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=6360&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Comments

0 comment