views

Australia Venture Capital Market Overview

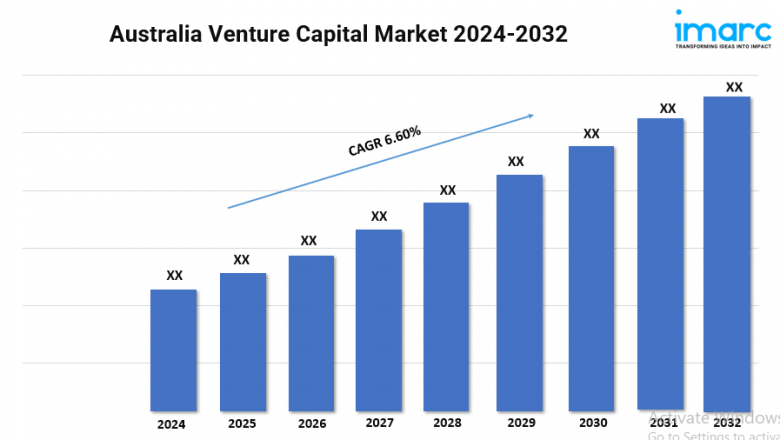

Base Year: 2023

Market Size in 2023: USD 2.54 Billion

Market Size in 2032: USD 4.79 Billion

Market Growth Rate: 6.60% (2024-2032)

Australia venture capital market has been experiencing significant growth in recent years, fueled by a thriving startup ecosystem and supportive government initiatives. According to the latest report by IMARC Group, the market is projected to exhibit a growth rate (CAGR) of 6.60% during 2024-2032.

Download sample copy of the Report: https://www.imarcgroup.com/australia-venture-capital-market/requestsample

Australia Venture Capital Industry Trends and Drivers:

Australia venture capital market has been experiencing significant growth in recent years, fueled by a thriving startup ecosystem and supportive government initiatives. The country's strong innovation culture, coupled with a growing number of talented entrepreneurs, has attracted the attention of both domestic and international investors.

The Australian government has played a crucial role in fostering the growth of the venture capital market through various initiatives. Government-backed funds and tax incentives have encouraged investment in early-stage startups. Additionally, the establishment of innovation hubs and accelerators has provided entrepreneurs with access to mentorship, funding, and networking opportunities.

However, the Australian venture capital market still faces some challenges. One major challenge is the relatively small size of the domestic market compared to other major tech hubs. This can limit the potential exit opportunities for startups, such as initial public offerings (IPOs) or mergers and acquisitions (M&As). Additionally, securing follow-on funding for later-stage growth can be difficult, especially for companies operating in niche or emerging sectors.

Despite these challenges, the Australian venture capital market remains optimistic about its future. The growing number of successful startups, coupled with increasing institutional investment, is driving the market forward. As the ecosystem continues to mature, Australia is well-positioned to become a global innovation hub.

We explore the factors propelling the Australia venture capital market growth, including technological advancements, consumer behaviors, and regulatory changes.

Australia Venture Capital Industry Segmentation:

The report has segmented the market into the following categories:

Sector Insights:

- Software

- Pharma and Biotech

- Media and Entertainment

- Medical Devices and Equipment

- Medical Services and Systems

- IT Hardware

- IT Services and Telecommunication

- Consumer Goods and Recreation

- Energy

- Others

Fund Size Insights:

- Under $50 M

- $50 M to $100 M

- $100 M to $250 M

- Above $250 M

Funding Type Insights:

- First-Time Venture Funding

- Follow-on Venture Funding

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

Street: Morgan Park QLD 4370

City/Town: Warwick

State/Province/Region: Queensland

Country: Australia

Zip/Postal Code: 4370

Email: sales@imarcgroup.com

Phone Number: +1-631-791-1145

Comments

0 comment