73

views

views

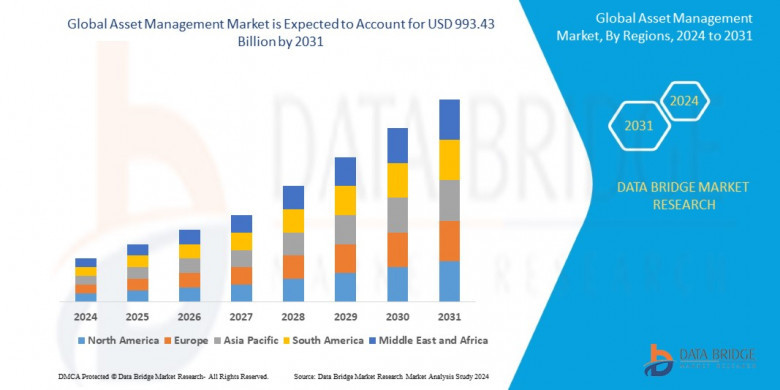

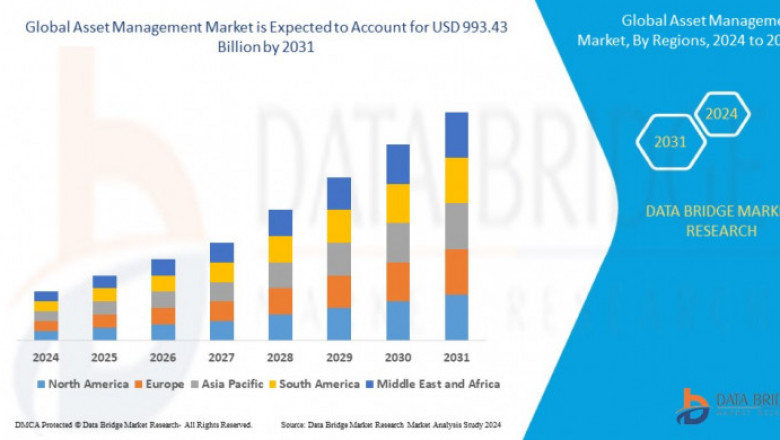

Data Bridge Market Research analyzes that the global asset management market which was USD 5.17 billion in 2023, is likely to reach up to USD 993.43 billion by 2031, and is expected to undergo a CAGR of 13% during the forecast period.

Comments

0 comment