views

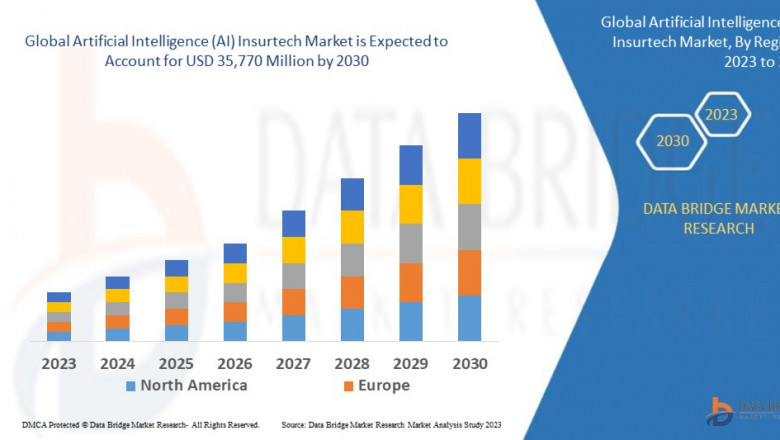

"Global Artificial Intelligence (AI) Insurtech Market - Size, Share, Industry Trends, Demand and Opportunities

Global Artificial Intelligence (AI) Insurtech Market, By Component (Hardware, Software, Services), Technology (Machine Learning and Deep Learning, Natural Language Processing (NLP), Machine Vision, Robotic Automation), Deployment Model (On-Premises, Cloud), Enterprises Size (Large Enterprises, SMEs Enterprises), Application (Claims Management, Risk Management and Compliance, Chatbots, Others), Sector (Life Insurance, Health Insurance, Title Insurance, Auto Insurance, Others) - Industry Trends and Forecast to 2030.

Access Full 350 Pages PDF Report @

https://www.databridgemarketresearch.com/reports/global-artificial-intelligence-ai-insurtech-market

**Segments**

- **Product Type**: The AI insurtech market can be segmented based on product type into solutions and services. Solutions include machine learning, natural language processing, computer vision, and others, while services consist of consulting, implementation, and training.

- **Deployment Mode**: Another segmentation factor is the deployment mode, which includes on-premises and cloud-based. Cloud-based deployment is increasingly preferred due to its scalability, cost-efficiency, and ease of implementation.

- **Insurance Type**: The market can also be divided based on insurance type, including health insurance, property and casualty insurance, life insurance, and others. Each insurance type has specific needs and challenges that AI insurtech can address effectively.

- **End-User**: End-user segmentation includes insurance companies, brokers, and agents. Insurers are the primary adopters of AI insurtech solutions, leveraging them to enhance customer experience, streamline operations, and drive profitability.

**Market Players**

- **IBM Corporation**: IBM offers AI solutions tailored for the insurance industry, including claims processing, fraud detection, and risk assessment. The company's AI capabilities help insurers improve decision-making and operational efficiency.

- **Lemonade**: Lemonade is a prominent insurtech company that leverages AI to offer personalized insurance products and a seamless digital experience. Its AI-powered chatbots assist customers in claims processing and policy management.

- **Microsoft Corporation**: Microsoft provides AI tools and services that empower insurers to leverage data insights for better underwriting, customer service, and risk management. Azure AI services enable insurers to build custom AI models.

- **Ant Financial**: Ant Financial utilizes AI algorithms for insurance risk analysis, fraud detection, and customer segmentation. The company's AI-driven solutions enhance the accuracy and speed of insurance operations.

- **ZhongAn Online P&C Insurance**: ZhongAn integrates AI technology into its insurance processes, offering innovative products such as health insurance with personalized pricing based on individual risk profiles. The company's AI initiatives focus on improving customer engagement and operational efficiency.

https://www.databridgemarketresearch.com/reports/global-artificial-intelligence-ai-insurtech-marketThe AI insurtech market is witnessing a significant transformation driven by technological advancements and changing consumer expectations. One emerging trend in the market is the increasing focus on personalized insurance products through AI algorithms. Insurtech companies are leveraging AI capabilities to analyze vast amounts of data and tailor insurance offerings to individual customer needs and risk profiles. This focus on personalization not only enhances customer satisfaction but also improves risk assessment accuracy for insurers, leading to more targeted and competitive insurance products in the market.

Another key development in the AI insurtech market is the integration of chatbots and virtual assistants powered by AI. These AI-driven tools are revolutionizing customer engagement and claims processing in the insurance industry. Chatbots provide instant assistance to policyholders, answering queries, guiding them through the claims process, and facilitating policy management efficiently. By automating these interactions, insurers can boost customer service levels, reduce response times, and enhance overall customer experience, ultimately fostering customer loyalty and retention in a highly competitive market landscape.

Moreover, the adoption of AI insurtech solutions is enabling insurers to mitigate risks more effectively through advanced predictive analytics and risk assessment models. AI algorithms can analyze historical data, market trends, and customer behavior patterns to identify potential risks proactively and develop risk mitigation strategies. By leveraging AI for risk management, insurers can enhance underwriting accuracy, reduce claims costs, and improve overall profitability. This proactive approach to risk management positions insurers as more agile and responsive to market dynamics, ultimately strengthening their competitive edge in the industry.

Furthermore, the increasing collaboration between traditional insurance players and insurtech startups is shaping the AI insurtech market landscape. Established insurers are partnering with technology companies to harness AI capabilities and accelerate digital transformation initiatives. These collaborations enable insurers to access cutting-edge technologies, innovative business models, and new distribution channels, expanding their reach and competitiveness in the market. By embracing collaboration and partnership strategies, insurers can tap into the disruptive potential of AI insurtech to drive innovation, efficiency, and sustainable growth in the evolving insurance ecosystem.

In conclusion, the AI insurtech market is poised for continued growth and innovation as companies embrace AI technologies to reimagine insurance products, processes, and customer interactions. The convergence of AI, data analytics, and digital technologies is reshaping the insurance industry, offering new opportunities for insurers to enhance operational efficiency, improve risk management practices, and deliver personalized customer experiences. As AI continues to drive transformation across the insurtech landscape, companies that invest in AI capabilities and strategic partnerships will be well-positioned to thrive in the digital age of insurance.**Segments**

- Global Artificial Intelligence (AI) Insurtech Market, By Component (Hardware, Software, Services), Technology (Machine Learning and Deep Learning, Natural Language Processing (NLP), Machine Vision, Robotic Automation), Deployment Model (On-Premises, Cloud), Enterprises Size (Large Enterprises, SMEs Enterprises), Application (Claims Management, Risk Management and Compliance, Chatbots, Others), Sector (Life Insurance, Health Insurance, Title Insurance, Auto Insurance, Others) - Industry Trends and Forecast to 2030.

The AI insurtech market is witnessing dynamic growth and transformation across various segments driven by technological advancements and changing market dynamics. The segmentation of the market based on product type into solutions and services provides a clear understanding of the diverse offerings within the AI insurtech space. Solutions such as machine learning, natural language processing, and computer vision cater to different needs within the insurance industry, while services like consulting and implementation support the successful integration and utilization of AI technologies. Understanding these segments is crucial for both vendors and buyers to align their strategies and investments effectively.

Deployment mode is another significant segmentation factor impacting the AI insurtech market, with the divide between on-premises and cloud-based solutions shaping how insurers adopt and leverage AI technologies. The shift towards cloud-based deployment is reshaping the market landscape due to its scalability, cost-efficiency, and ease of implementation. Cloud-based solutions offer insurers greater flexibility and agility in deploying AI applications, enabling quicker innovation and responsiveness to market demands. As insurers increasingly prioritize digital transformation and scalability, cloud-based AI solutions are likely to dominate the market in the coming years.

Segmenting the market based on insurance type provides insights into how different sectors within the insurance industry are leveraging AI insurtech solutions. Health insurance, property and casualty insurance, life insurance, and other specialized insurance segments each have unique requirements and challenges that AI technologies can address. For instance, AI-powered risk assessment and fraud detection systems are particularly valuable for property and casualty insurers, while personalized pricing models driven by AI algorithms are transforming health insurance offerings. Understanding these sector-specific needs is vital for AI insurtech providers to tailor their solutions effectively and drive value for insurers.

End-user segmentation plays a crucial role in shaping the adoption and impact of AI insurtech solutions in the market. Insurance companies, brokers, and agents represent the key stakeholders driving the demand for AI technologies in the insurance sector. Insurers, in particular, are at the forefront of adopting AI insurtech solutions to enhance operational efficiency, improve customer experience, and drive profitability. As insurers continue to explore the transformative potential of AI across various functions such as claims processing, underwriting, and customer service, targeting their specific needs and pain points becomes essential for AI insurtech vendors to deliver tailored solutions that drive business outcomes.

**Market Dynamics**

The AI insurtech market is poised for significant growth and innovation, driven by several key market dynamics. One of the emerging trends reshaping the market is the increasing focus on personalized insurance products powered by AI algorithms. Insurtech companies are leveraging AI capabilities to analyze extensive data sets and customize insurance offerings based on individual customer profiles and risk assessments. This emphasis on personalization not only enhances customer satisfaction but also enables insurers to offer more targeted and competitive products, ultimately improving their market positioning and competitiveness.

In addition to personalization, the integration of chatbots and virtual assistants enabled by AI is revolutionizing customer engagement and claims processing in the insurance industry. AI-driven chatbots provide instant support to policyholders, guiding them through the claims process, answering inquiries, and facilitating policy management efficiently. By automating these interactions, insurers can enhance customer service levels, reduce response times, and deliver a seamless customer experience, fostering loyalty and retention in a highly competitive market environment.

Furthermore, the adoption of AI insurtech solutions enables insurers to enhance risk management practices through advanced predictive analytics and risk assessment models. AI algorithms can analyze historical data, market trends, and customer behaviors to identify potential risks proactively and develop effective risk mitigation strategies. By leveraging AI for risk management, insurers can improve underwriting accuracy, reduce claims costs, and enhance overall profitability. This proactive risk management approach not only strengthens insurers’ ability to respond to market dynamics but also positions them as more resilient and agile in managing evolving risks and uncertainties.

Collaboration and partnerships between traditional insurance players and insurtech startups are driving significant transformations in the AI insurtech market. Established insurers are increasingly partnering with technology companies to leverage AI capabilities and accelerate their digital transformation initiatives. These collaborations enable insurers to access innovative technologies, new business models, and distribution channels, expanding their market reach and competitiveness. By embracing collaboration and partnership strategies, insurers can harness the disruptive potential of AI insurtech to drive innovation, operational efficiency, and sustainable growth in the evolving insurance landscape.

**Market Outlook**

In conclusion, the AI insurtech market presents vast opportunities for growth and innovation as insurers and technology providers continue to harness the power of AI technologies to reshape the insurance industry. The convergence of AI, data analytics, and digital technologies is driving fundamental shifts in how insurance products are developed, processes are optimized, and customer interactions are personalized. By focusing on segmentation factors such as product type, deployment mode, insurance type, and end-users, AI insurtech vendors can better align their offerings with market demands and cater to the evolving needs of insurers.

As the market evolves, the continued emphasis on personalization, automation, and risk management through AI technologies will be key drivers of growth and competitive differentiation in the AI insurtech space. By staying abreast of emerging trends, market dynamics, and collaboration opportunities, companies can position themselves as innovators and value drivers in the AI insurtech ecosystem. Looking ahead, companies that invest in AI capabilities, forge strategic partnerships, and deliver tailored solutions that address market needs will be well-positioned to thrive in the digital age of insurance, driving sustainable growth and value creation in the competitive marketplace.

Core Objective of Artificial Intelligence (AI) Insurtech Market:

Every firm in the Artificial Intelligence (AI) Insurtech Market has objectives but this market research report focus on the crucial objectives, so you can analysis about competition, future market, new products, and informative data that can raise your sales volume exponentially.

- Size of the Artificial Intelligence (AI) Insurtech Market and growth rate factors.

- Important changes in the future Artificial Intelligence (AI) Insurtech Market.

- Top worldwide competitors of the Market.

- Scope and product outlook of Artificial Intelligence (AI) Insurtech Market.

- Developing regions with potential growth in the future.

- Tough Challenges and risk faced in Market.

- Global Artificial Intelligence (AI) Insurtech top manufacturers profile and sales statistics.

Highlights of TOC:

Chapter 1: Market overview

Chapter 2: Global Artificial Intelligence (AI) Insurtech Market

Chapter 3: Regional analysis of the Global Artificial Intelligence (AI) Insurtech Market industry

Chapter 4: Artificial Intelligence (AI) Insurtech Market segmentation based on types and applications

Chapter 5: Revenue analysis based on types and applications

Chapter 6: Market share

Chapter 7: Competitive Landscape

Chapter 8: Drivers, Restraints, Challenges, and Opportunities

Chapter 9: Gross Margin and Price Analysis

Regional Analysis for Artificial Intelligence (AI) Insurtech Market:

- APAC (Japan, China, South Korea, Australia, India, and Rest of APAC; Rest of APAC is further segmented into Malaysia, Singapore, Indonesia, Thailand, New Zealand, Vietnam, and Sri Lanka)

- Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe; Rest of Europe is further segmented into Belgium, Denmark, Austria, Norway, Sweden, The Netherlands, Poland, Czech Republic, Slovakia, Hungary, and Romania)

- North America (U.S., Canada, and Mexico)

- South America (Brazil, Chile, Argentina, Rest of South America)

- MEA (Saudi Arabia, UAE, South Africa)

Browse Trending Reports:

Aircraft Survivability Equipment Market Size, Share and Trends

Bakeware Market Size, Share and Trends

Polycarbonate (PC) and Polycarbonate/Acrylonitrile Butadiene Styrene (PC/ABS) in Information Technology (IT) Server Market Size, Share and Trends

Fire Detection System Market Size, Share and Trends

Glycylcyclines Market Size, Share and Trends

Middle East and Africa Fiber Optic Connector in Telecom Market Size, Share and Trends

Flavours - Fragrances Market Size, Share and Trends

Elastomeric Sealants Market Size, Share and Trends

Thrombectomy Devices Market Size, Share and Trends

Natural and Synthetic Biomedical Adhesives Market Size, Share and Trends

Percutaneous Nephroscope Market Size, Share and Trends

Gypsum Board Market Size, Share and Trends

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Comments

0 comment