views

"Accounts Receivable Automation Market Size And Forecast by 2028

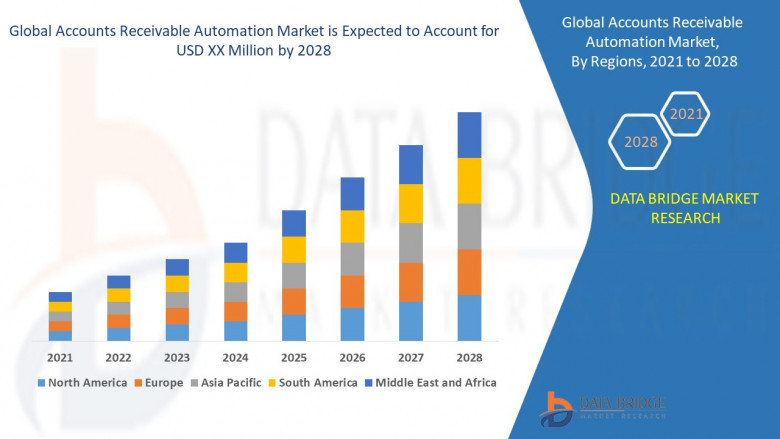

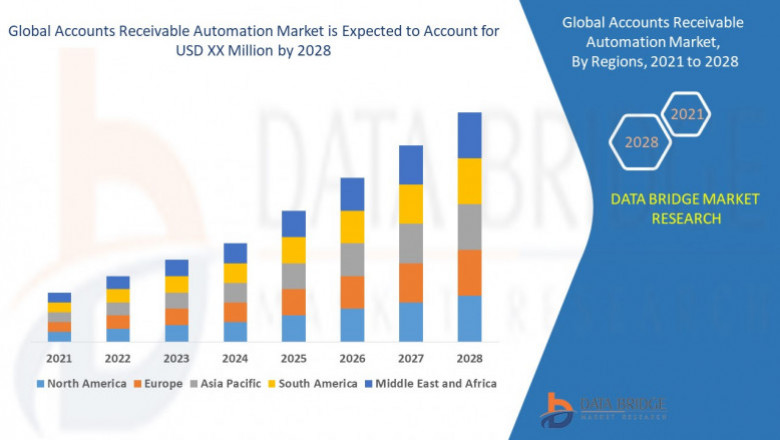

According to Data Bridge Market Research The accounts receivable automation market is expected to witness market growth at a rate of 13.01% in the forecast period of 2021 to 2028.

Accounts Receivable Automation Market aims to expand its operations with strategic initiatives and global investments. With a strong roadmap, AI-Based Billing and Invoicing Market plans to enter new markets and increase its footprint. The expansion strategy of Smart Financial Transactions Market includes technological advancements and enhanced service models. Digital Payment Collection Solutions Market is committed to maintaining leadership through progressive developments. Future innovations from Accounts Receivable Automation Market will redefine industry standards and drive business growth.

As a leader, Accounts Receivable Automation Market sets new standards by implementing groundbreaking solutions. The contributions of Automated Invoice Processing Market to the industry reflect its strong commitment to excellence. By investing in sustainable practices, Accounts Receivable Automation Market ensures long-term success. The leadership of Accounts Receivable Automation Market inspires innovation and fosters competition within the sector. Electronic Accounts Receivable Market continues to reinforce its position through forward-thinking strategies and visionary growth.

Our comprehensive Accounts Receivable Automation Market report is ready with the latest trends, growth opportunities, and strategic analysis. https://www.databridgemarketresearch.com/reports/global-accounts-receivable-automation-market

**Segments**

- Based on Component: Software, Services

- Based on Organization Size: Small and Medium-Sized Enterprises (SMEs), Large Enterprises

- Based on Deployment Type: On-Premises, Cloud

- Based on End-User: BFSI, Retail, Healthcare, IT and Telecom, Manufacturing, Others

The global accounts receivable automation market is segmented by component, organization size, deployment type, and end-user industry. In terms of components, the market is divided into software and services. The software segment is anticipated to witness significant growth due to the increasing adoption of automated solutions for efficient accounts receivable management. Organization size segmentation includes small and medium-sized enterprises (SMEs) and large enterprises. SMEs are expected to adopt accounts receivable automation solutions at a higher rate to streamline their financial operations and enhance cash flow management. Deployment type segmentation comprises on-premises and cloud solutions. The cloud-based deployment model is projected to dominate the market as it offers scalability, flexibility, and cost-effectiveness. Furthermore, the end-user industries in the market include BFSI, retail, healthcare, IT and telecom, manufacturing, and others.

**Market Players**

- Sage Intacct, Xero, Zoho Corporation Pvt. Ltd, FreshBooks, Planview, Scoro, GLOVIA G2, Priority Software, NetSuite Global Business Unit, Plooto, Micronetics, Workday, Inc., CCH Tagetik, Taskfreak!, Elorus, DCOA

- IBM Corporation, SAP SE, Microsoft, Oracle, HighRadius, Sage Group, FIS, Fiserv, Invoicely, MineralTree, Micronetics, Basware, Kabbage, Sage, Nvoicepay

Key market players in the global accounts receivable automation market include Sage Intacct, Xero, Zoho Corporation Pvt. Ltd, FreshBooks, Planview, Scoro, GLOVIA G2, Priority Software, NetSuite Global Business Unit, Plooto, Micronetics, Workday, Inc., CCH Tagetik, Taskfreak!, Elorus, DCOA, IBM Corporation, SAP SE, Microsoft, Oracle, HighRadius, Sage Group, FIS, Fiserv, Invoicely, MineralTree, Basware, Kabbage, Sage, Nvoicepay. These players are actively focusing on mergers, acquisitions, partnerships, and product innovations to consolidate their market presence and expand their customer base in the global accounts receivable automation market.

https://www.databridgemarketresearch.com/reports/global-accounts-receivable-automation-Market The accounts receivable automation market is poised for substantial growth driven by a surge in demand for efficient financial management solutions across various industries. One key trend shaping this market is the increasing adoption of cloud-based deployment models due to their scalability, flexibility, and cost-effectiveness. Cloud solutions offer businesses the ability to access real-time data from anywhere, improving overall operational efficiency. Furthermore, the software segment is expected to experience significant growth as companies seek automated solutions to streamline their accounts receivable processes effectively.

Moreover, the market is witnessing a notable shift towards automation solutions among small and medium-sized enterprises (SMEs) to enhance cash flow management and financial operations. SMEs are increasingly recognizing the benefits of accounts receivable automation in improving their financial health and competitiveness in the market. On the other hand, large enterprises are also embracing automation technologies to drive operational efficiency and optimize their accounts receivable processes.

In terms of end-user industries, the BFSI (Banking, Financial Services, and Insurance) sector is poised to be a key adopter of accounts receivable automation solutions. The BFSI industry faces complex financial transactions and a high volume of invoices, making automation crucial for improving accuracy and efficiency in managing accounts receivable. Additionally, the retail, healthcare, IT and telecom, and manufacturing sectors are also expected to drive market growth as they realize the benefits of automated financial management solutions in optimizing cash flow and reducing manual errors.

The competitive landscape of the accounts receivable automation market is characterized by intense competition among key players such as SAP SE, IBM Corporation, Microsoft, Oracle, and Sage Intacct. These market players are actively involved in strategic initiatives such as mergers, acquisitions, partnerships, and product innovations to strengthen their market position and cater to the evolving needs of customers. By expanding their product portfolios and leveraging advanced technologies like artificial intelligence and machine learning, these companies aim to offer cutting-edge solutions that meet the increasing demand for automated accounts receivable processes.

In conclusion, the global accounts receivable automation market is set for robust growth driven by the rising adoption of cloud-based solutions, increasing awareness among SMEs, and the growing need for efficient financial management across various industries. Key market players are poised to capitalize on these trends by investing in innovation and strategic partnerships to maintain their competitive edge in the market. As businesses increasingly prioritize automation to streamline their accounts receivable processes, the market is expected to witness further expansion and evolution in the coming years.**Segments:**

The Global Accounts Receivable Automation Market, By Component (Solution and Services), Organization Size (Small and Medium Enterprises and Large Enterprises), Deployment Type (On-Premises and Cloud), Industry (BFSI, IT and Telecom, Manufacturing, Consumer Goods and Retail, Healthcare, Energy and Utilities and Others), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of the Middle East and Africa) Industry Trends and Forecast to 2028:

- The market for accounts receivable automation solutions is witnessing significant growth, driven by the increasing adoption of cloud-based deployment models for enhanced scalability and cost-effectiveness.

- SMEs are increasingly turning to automation solutions to improve cash flow management and operational efficiency.

- The BFSI sector is expected to be a key adopter of accounts receivable automation due to the complex financial transactions and high invoice volumes it faces.

- Market players are focusing on strategic initiatives like mergers, acquisitions, and partnerships to strengthen their market presence and cater to evolving customer needs.

**Market Players:**

- Oracle

- Sap SE

- Workday, Inc.

- Bottomline Technologies (de), Inc.

- Comarch SA

- HighRadius

- FinancialForce

- Esker

- Emagia Corporation

- YayPay Inc.

- VersaPay Corporation

- KOFAX, Inc.

- Office Torque

- Swiss Post Solutions Inc.

- API Outsourcing Inc

- Anytime Collect

- numberz

- OnPay Solutions

- Qvalia AB

- MYOB Technology Pty Ltd

Market share data is available for global, North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and South America separately. Key players are actively involved in competitive analysis and are focusing on different strategies to maintain their competitive edge in the market. Mergers, acquisitions, and product innovations remain key strategies for players looking to expand their market share and cater to the evolving demands of customers. The market landscape is intensely competitive, with players leveraging advanced technologies like artificial intelligence and machine learning to offer cutting-edge solutions that address the increasing demand for automated accounts receivable processes effectively.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies in Accounts Receivable Automation Market : https://www.databridgemarketresearch.com/reports/global-accounts-receivable-automation-market/companies

Key Questions Answered by the Global Accounts Receivable Automation Market Report:

- What is the current state of the Accounts Receivable Automation Market, and how has it evolved?

- What are the key drivers behind the growth of the Accounts Receivable Automation Market?

- What challenges and barriers do businesses in the Accounts Receivable Automation Market face?

- How are technological innovations impacting the Accounts Receivable Automation Market?

- What emerging trends and opportunities should businesses be aware of in the Accounts Receivable Automation Market?

Browse More Reports:

https://www.databridgemarketresearch.com/reports/spain-accounts-receivable-automation-market

https://www.databridgemarketresearch.com/nucleus/spain-accounts-receivable-automation-market

Data Bridge Market Research:

☎ Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 985

Comments

0 comment