Mitolyn Ingredients Label

-

Valued at USD 4.4 billion in 2024, the market is projected to reach USD 6.8...

Factual Market Research proudly presents our highly anticipated “Methylpara...

Turkish Airlines Athens Office +1-888-839-0502

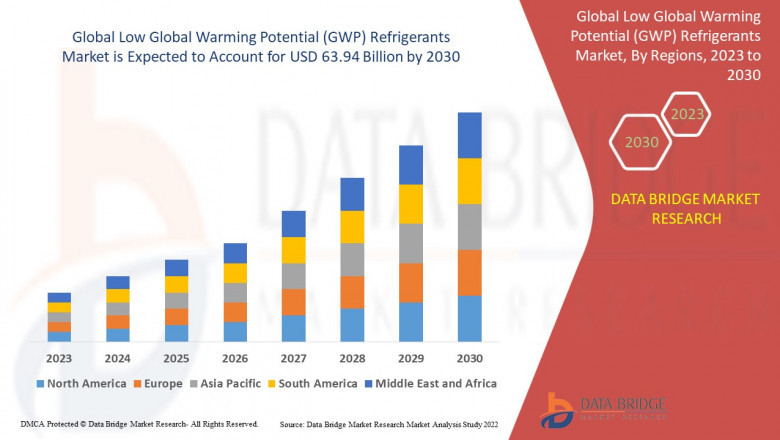

Data Bridge Market Research Data Bridge Market Research analyses that the G...

Explore Laser Hair Removal cost in Dubai starts from 3,00 AED. Get affordab...